4️⃣ Comma Partners: April 2025

Steadier - for now. Gold is showing us the way

Welcome to Comma Partners

A new-paradigm crypto fund investing at the frontier of

community, technology, culture, & capital

Devin here, back again for the April update for Comma Partners.

In last month’s update, we spent the vast majority of the time discussing Trump’s Liberation Day tariff plan.

Believe it or not, that was just one month ago. Time with Trump in charge is like dog years

Let’s jump into what’s happened since.

State-of-the-union

For the month of April:

Crypto:

BTC +14%

ETH (-2%)

SOL +19%

Equities:

S&P 500 (-0%)

NASDAQ +4%

Gold:

Gold +4%

Crypto’s resilience

In last month’s update, published April 5th, I noted that crypto was holding strong - and that it was too early to say with confidence that this strength was here to stay.

It’s still early - sitting only about a month out - but that strength has generally held.

I still hold the belief that each time we’re faced with sudden, dramatic change that’s imposed by someone that’s in charge, the world moves one step closer to realizing the value of a neutral, independent, and non-sovereign system that exists outside of our traditional ones.

A quick lesson on the anatomy of the financial plumbing

Given the massive cannonball the Trump administration just yeeted into the pool of the global economy on April 2nd, I’ve been thinking a lot about how these ripple effects will play out.

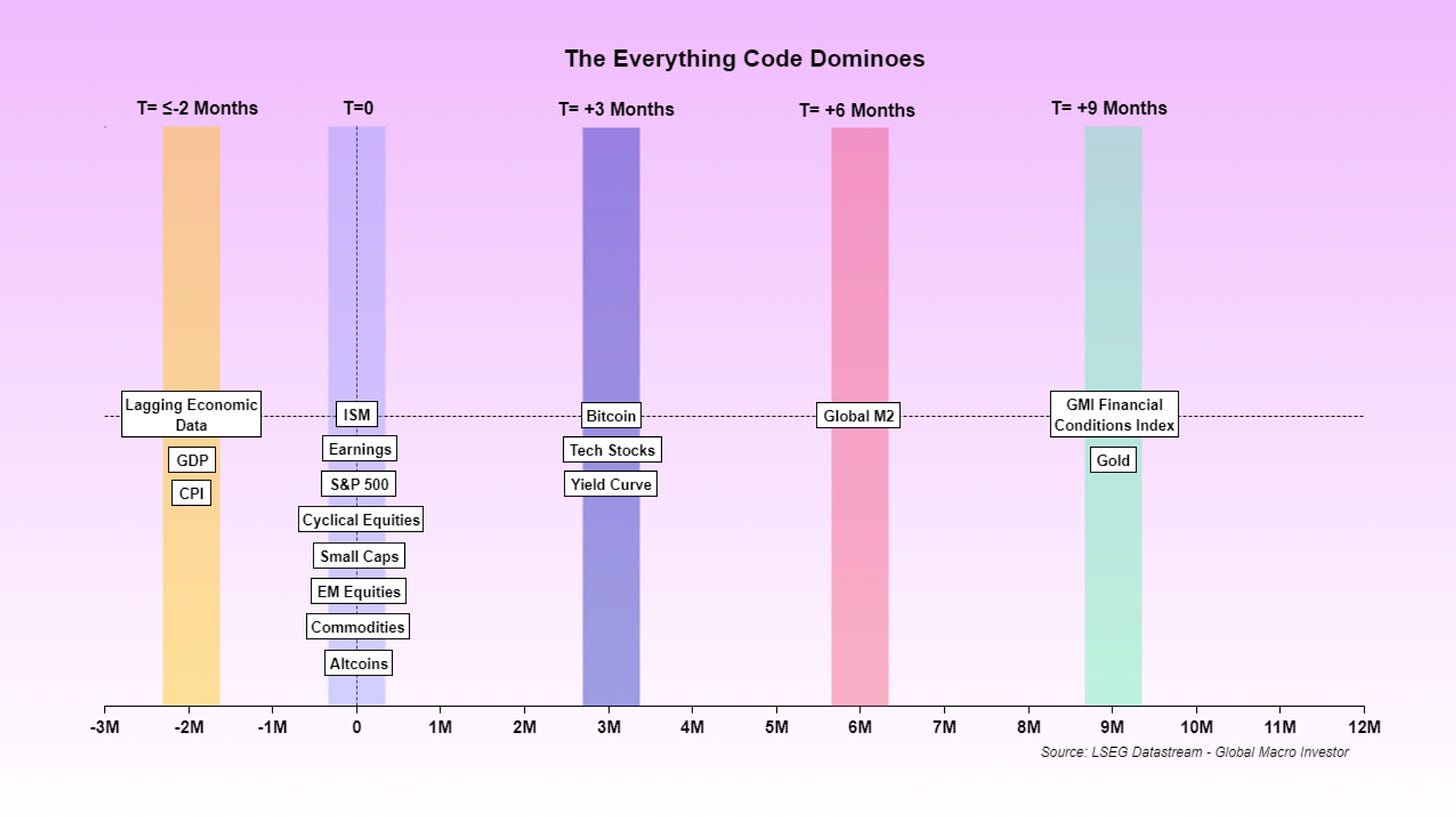

Raoul Pal and Julien Bittel at Global Macro Investor just published some amazing work on understanding what they call the “Everything Code dominoes.” They provide a great framework for thinking about how world events ripple through markets, and how the pieces are all connected.

I’d like to share some of the insights with you.

Gold & financial conditions

Gold is coincident with the financial conditions (largely driven by the strength of the dollar, oil prices, and rates) as they evolve on the field. It is the real-time barometer of investors’ POV and positioning in response to events unfolding in the world.

Financial conditions have been easing materially, and gold has been on a tear this year.

The USD:

Oil:

Rates:

Gold:

Liquidity

Liquidity follows gold.

It takes about three months for the financial conditions to open the spigot of additional liquidity (if financial conditions are easing), or to sop up existing liquidity (if financial conditions are tightening).

The reason here is simple. If people need to spend more on dollar-denominated things in their day-to-day (e.g., products, services, debt service costs) because financial conditions are tightening (e.g., a stronger dollar, more expensive oil/gas inputs, and/or higher costs of debt), then there’s less money left over (i.e., liquidity) for other spending and investment.

Innovation assets

Three months after that, “innovation” assets (e.g., crypto, tech stocks) follow.

Same logic here. Investing in innovation with inherent uncertainty with respect to its future prospects can only take place after core needs (for both individuals and businesses) are taken care of.

M2 with a 3-month lead vs. Bitcoin:

Gold with a 6-month lead vs. Bitcoin:

Gold with a 6-month lead vs. the NASDAQ:

The business cycle

And after three more months, the business cycle catches these ripple effects.

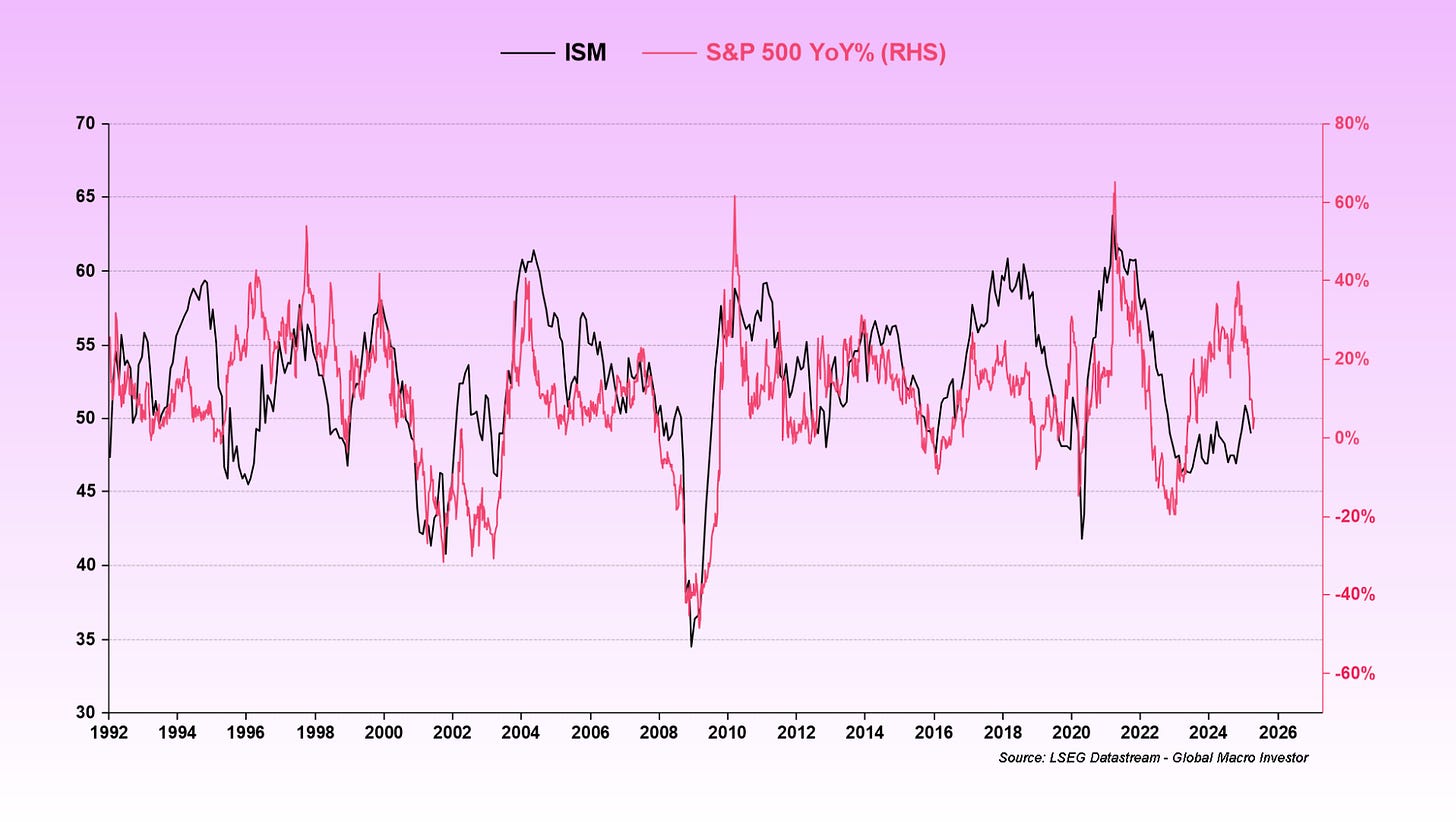

This shows up in metrics like the ones supplied by the ISM (surveys that track the health of the manufacturing and services sectors).

Alongside the business cycle comes the rest of asset markets, including assets further out on the risk curve, including in crypto.

Financial conditions with a 9-month lead vs. the ISM:

The ISM vs. the S&P 500:

The ISM vs. altcoins:

A recap

Ripple effects take time to flow through the layers of the markets, hence the lag between the various stages.

What it means looking forward

Let’s recap.

Financial conditions have eased

Dollar down.

Oil down.

Rates down.

This means financial conditions are easing. Dramatically. And Fast.

Gold has been on a tear. In my view, this is reflecting both financial conditions, but also a broader response to the vast uncertainty we’ve encountered, especially in the last month.

For about a week after Liberation Day, the VIX stayed above 50.

All the while, the world fled to gold.

So, here we are now, into May, with dramatically looser financial conditions than the start of the year and liquidity at an all-time high (and increasing).

There are risks as the end state of the realignment of global trade unfolds

We have yet to see the full impact of the trade disruption.

We are starting to see a bit of an impact with an uptick in jobless claims, but signals are mixed non-farm payrolls are strong and the PMI is holding up.

But as mentioned above, these sorts of things take time to trickle through the layers of the economy and show up in the data.

We’ll be watching closely for the eventual (likely negative) impact on the real economy.

We also still have real uncertainty with respect to how trade negotiations get resolved, and where the imposed tariffs will ultimately end up.

But, we have greater clarity

That said, our belief is that Trump has already signaled the worst he will allow, and what he will do to bring us back.

Unlike Trump’s first term, It turns out that he is watching the debt markets - not the stock markets.

As 10-year rates touched 4.5% in the days following Liberation Day, Trump released some tariff pressure by announcing a 90-day pause.

The US’s massive debt load and refinancing needs (~$9 trillion needs to be refinanced this year alone, not to mention the ~7% debt-financed deficit we’re still running annually, or the proposed federal budget which would expand the deficit) necessitates attention on the rate markets.

If we approach 4.5% again, look for Trump to ease up on tariff plans.

On top of all of this, eventually, we expect some weaker economic data to reflecting negative impacts of tariff policy, which would give the Fed more room to cut rates and ease from their side.

The Fed has already stated that they view current rates as restrictive, and with no threat of inflation in sight, any impending economic weakness (particularly in the labor markets) should unleash them to cut.

I am erring on the side of assuming the Fed will be slow to respond, given that’s what they’ve shown us time and time again. We saw it today with their decision to hold rates steady. But the flip side of this is that once they do start cutting, they’re likely to go long, stretching the easing cycle further into 2026.

My base case is that we get no cut in June given the strength of the economic data we’re seeing.

Polymarket instantly reflected the strong payroll data last week, as odds of no change in June jumped from ~50% to above 80%.

Let’s keep watching the data.

But let’s not forget the rest of the world. To the extent the US is negatively impacted from all of this, the rest of the world will be even moreso. Which will lead to more widespread support from central banks around the world.

As we’ve said before, China is still facing a brutal economic situation, and they’ve been waiting to stimulate until the dollar weakens so that they don’t nuke their currency.

The TL;DR

To me, macro is looking great.

Could we re-test the lows again if faced with a more protracted trade negotiation than currently expected?

Sure.

But could we also steadily march through year-end as these liquidity tailwinds keep strengthening?

Sure.

While it’s still foggy, we certainly have more clarity than we did after Liberation Day.

Plus, just yesterday, Scott Bessent announced that he would be meeting with China this coming weekend to start trade talks. On the margin, this is positive, and brings increased clarity.

And if we drop to new lows in crypto and equity markets, our view is that we can confidently look to the bond market to signal where and when we’ll get support.

While this scenario playing out would sting, we’d bet the resulting weaker economic backdrop would support an even bolder and more sustained period of support from the Fed and other central banks.

But, as always, we must keep an eye out for the dramatic idiosyncratic risk that Trump can lob into our news feeds with a single announcement, as we so often see with him at the helm.

But that said, if I had to bet, I’d bet that we’ve bottomed for the year.

Last month, I said this:

If we continue to see crypto hold up strongly relative to equities, I get even more confident in a strong 2025 for crypto.

Here we are (so far).

The appeal of crypto is even stronger as we see the impact one person can have on manipulating the entire global economy.

Crypto’s prospects over the long-term are brighter than ever.

Where are we in the crypto cycle?

🟢 Overall, I’d still give us a green light (if we don’t enter a recession).

None of the 6 technical/valuation metrics below are in the warning zone.

These will only matter if we stay out of a broader economic recession.

Bitcoin dominance

Currently: ~65%

Warning zone: ~45%-50% (bottomed ~40% last cycle)

MVRV & Z-score

MVRV

Currently: ~2.2

Warning zone: ~3-3.5 (topped ~3.9 last cycle)

MVRV Z-score

Currently: ~2.3

Warning zone: ~6-7 (topped ~7.5 last cycle)

NUPL

Currently: ~0.54

Warning zone: ~0.6-0.7 (topped ~0.75 last cycle)

Puell multiple

Currently: ~1.1

Warning zone: ~2 (topped ~3.25 last cycle)

Pi cycle top indicator

Currently: not near a cross

Warning zone: when blue line approaches purple line

Some things I’ve been thinking about

Also all on Farcaster

Interesting reads, watches, listens

David Senra (Founders Podcast) on Invest Like the Best

David Whyte on how to heal the anxious self

Related things you might enjoy ⬇️

If you enjoyed this newsletter, forward it to a curious friend and tell them which idea they'd love.

Click here to watch and listen to spoken versions of essays, stories, and musings on YouTube.

To watch and listen on podcast apps:

Click here to read the archive.

Click here to follow on Twitter.

If you were forwarded this email, click the button below ⬇️ and enter your email to subscribe.