6️⃣ Comma Partners: June 2025

Still accelerating

Welcome to Comma Partners

A new-paradigm crypto fund investing at the frontier of

community, technology, culture, & capital

What a year it’s been so far.

Sometimes, it feels like nothing ever happens. Other times it feels like everything happens at once.

2025 feels like the latter.

Try to remember back to just after the new year, and what you thought 2025 was going to be like.

Hard to believe, huh?

I think we’re set up for an incredibly strong remainder of the year.

We’ve cemented this paradigm shift from austerity to acceleration, and the cherry on top is that macro is looking even stronger.

Dips are still for buying.

State-of-the-union

For the month of June:

Crypto:

BTC +3%

ETH (-1%)

SOL (-1%)

Equities:

S&P 500 +5%

NASDAQ +7%

Gold:

Gold +0%

Macro vs. micro

June was a month of macro vs. micro.

Macro’s setup is much like you and I explored last month. Strong and improving. We’ll get into the latest in a bit.

And yet June in many ways felt like echoes of April. Idiosyncratic and dramatic headlines that drove chop and volatility.

Tariffs. Israel bombing Iran. Iran bombing Israel. The US bombing Iran. A ceasefire to the “12-day war.”

You got to give it to him, DJT has a thing for theatrical storytelling and branding. He knows how to make a headline. Liberation Day. Operation Midnight Hammer. The One Big Beautiful Bill Act.

What can we learn from this?

First, time horizon matters.

The answer to what we can learn, and what actions are the right ones to take, depend greatly on what time horizon you’re playing with.

If you’re optimizing for daily or weekly wins, the micro idiosyncrasies matter much more.

Second, the craft is in evaluating what graduates from micro to macro.

The challenge? Properly determining which events cause ripples that reverberate beyond the immediate moment to drive reality over longer timescales.

Let’s look at the conflict in Iran as an example. If these tensions were to escalate into a protracted conflict, drawing in more death, destruction, fear, uncertainty, resources, nation-states, or the like - then that would be micro turning into macro, and a real factor looking out to and through the end of the year.

For us here at Comma, with a long, multi-year and multi-decade mission, we’re learning it’s rarely a good idea to act based on fears that arise from moment-to-moment headlines of geopolitics.

We’re learning that it’s a better strategy for us to exhibit patience beyond what the immediate discomfort - or even downright fear - arising from these headlines would counsel in the moment.

We believe in a long-term vision for what crypto and its technology can do in the world.

We also believe in the impacts of the macro environment on this long-term vision, and the insight we can gain from its signals.

That said, we position for the former first and foremost, and take guidance from macro second. Not the other way around.

And like I said, this doesn’t make it easy. Or simple, for that matter. But this is the craft that we are honing. Pulling signal from noise, macro from micro, and keeping the long-term vision locked in our sights, while navigating through pitfalls, obstacles, catalysts, and accelerants in the nearer-term along the way.

And here, you get a glimpse of what we’re seeing and thinking about along the way.

Macro looks great, and Trump is pouring fuel on the fire

Let’s take a look at how macro’s doing.

Nothing stops this train: policy has firmly shifted from austerity to acceleration

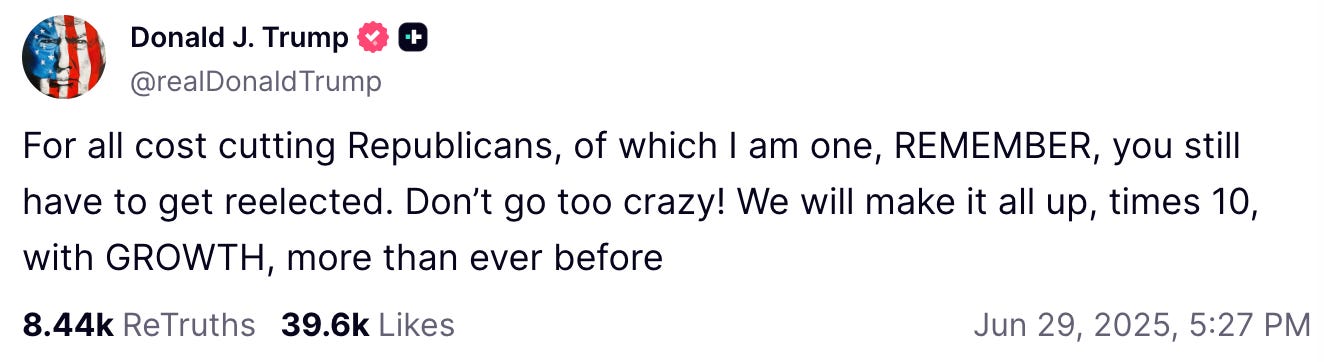

Trump (basically):

We will grow our way out of it all, damnit. Don’t get in my way.

On July 4th, the OBBBA was officially signed into law, and with it:

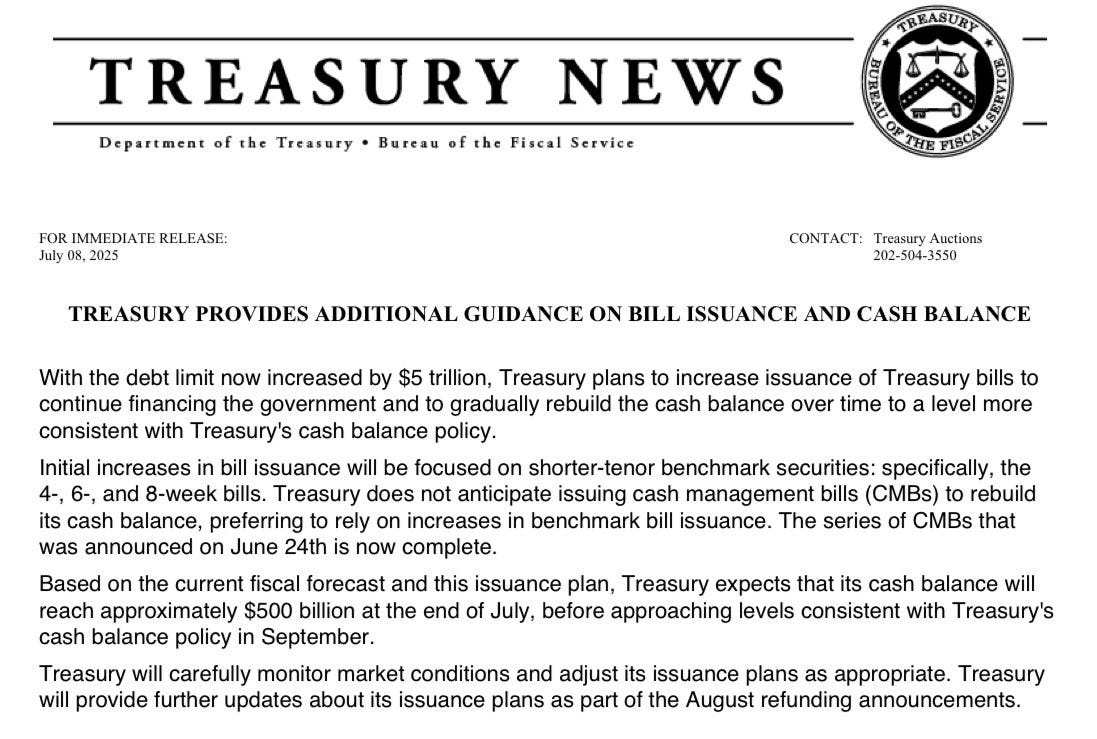

An additional $5T in debt issuance over the coming years

A projected $2.5T annual deficit - up from ~$1.8T last year and more than double 2019’s ~$1.0T - even before accounting for higher interest costs as we continue to issue new and more debt

As a result, the US’s prospects for issuing debt to fund this ever-larger largesse are deteriorating. More supply with the same (and maybe even less) demand means more expensive debt. This means even larger deficits, more debt supply, and even more expensive debt. This is the debt death spiral.

This means Scott Bessent and the US Treasury need ways to reign in the cost of their debt - and find new demand - fast.

How are they doing this?

Issuing more short-term (and less long-term) debt: the government has more control of short-term rates as a result of policy decisions than longer-term rates, which are more market-based

Working to pass the GENIUS Act to formalize regulation and unleash stablecoin proliferation: under the regulatory framework, every stablecoin has to be backed 100% by US dollars, which increases demand for short-term US debt

Working to lower or eliminate the Supplementary Leverage Ratio (SLR) requirement on banks: this would free up more cash for them to buy more short-term US debt, increasing demand

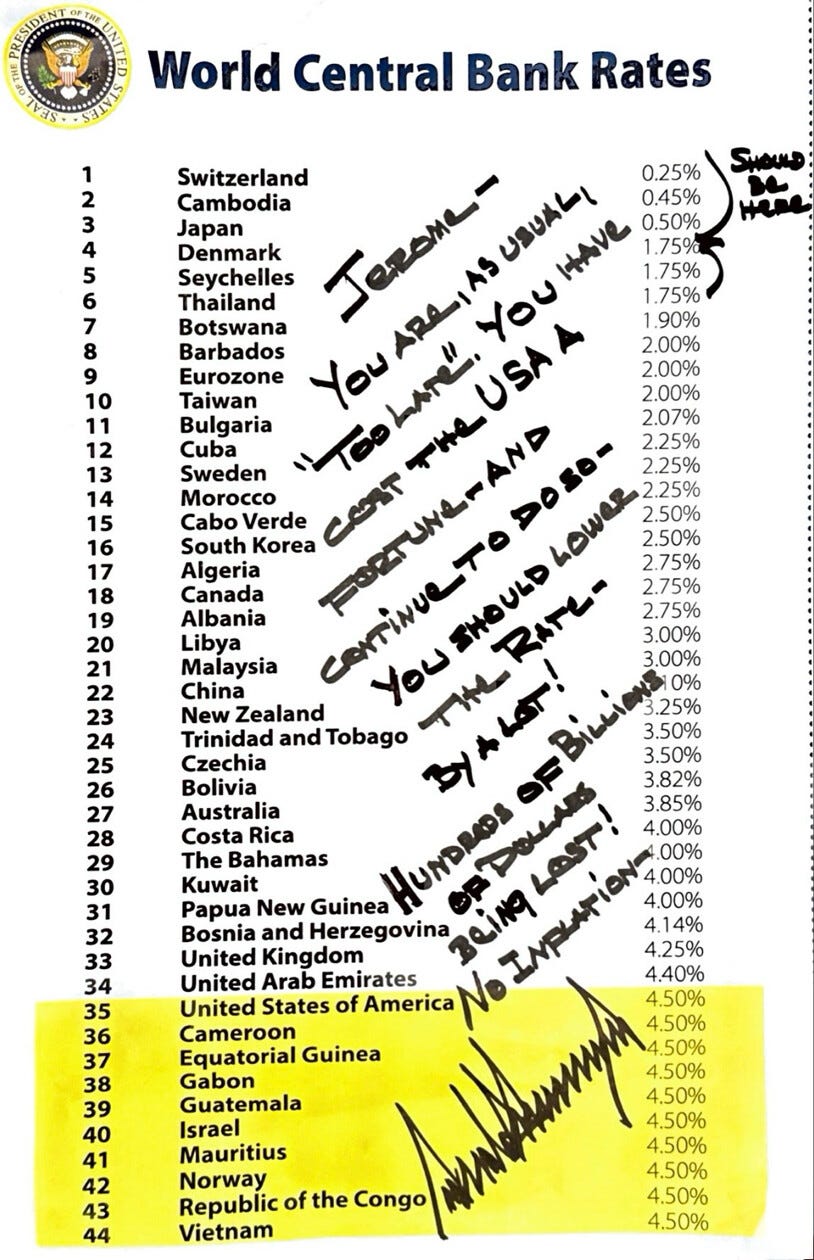

Pressuring the Fed to cut rates to decrease the cost of debt and fuel economic growth: this would lower interest costs for the government, shrink the deficit, and lower the debt-to-GDP ratio, thus making US debt more attractive, and increasing demand

This all means easier financial conditions, and more liquidity - on top of a macro setup that’s already very strong.

Liquidity is rising

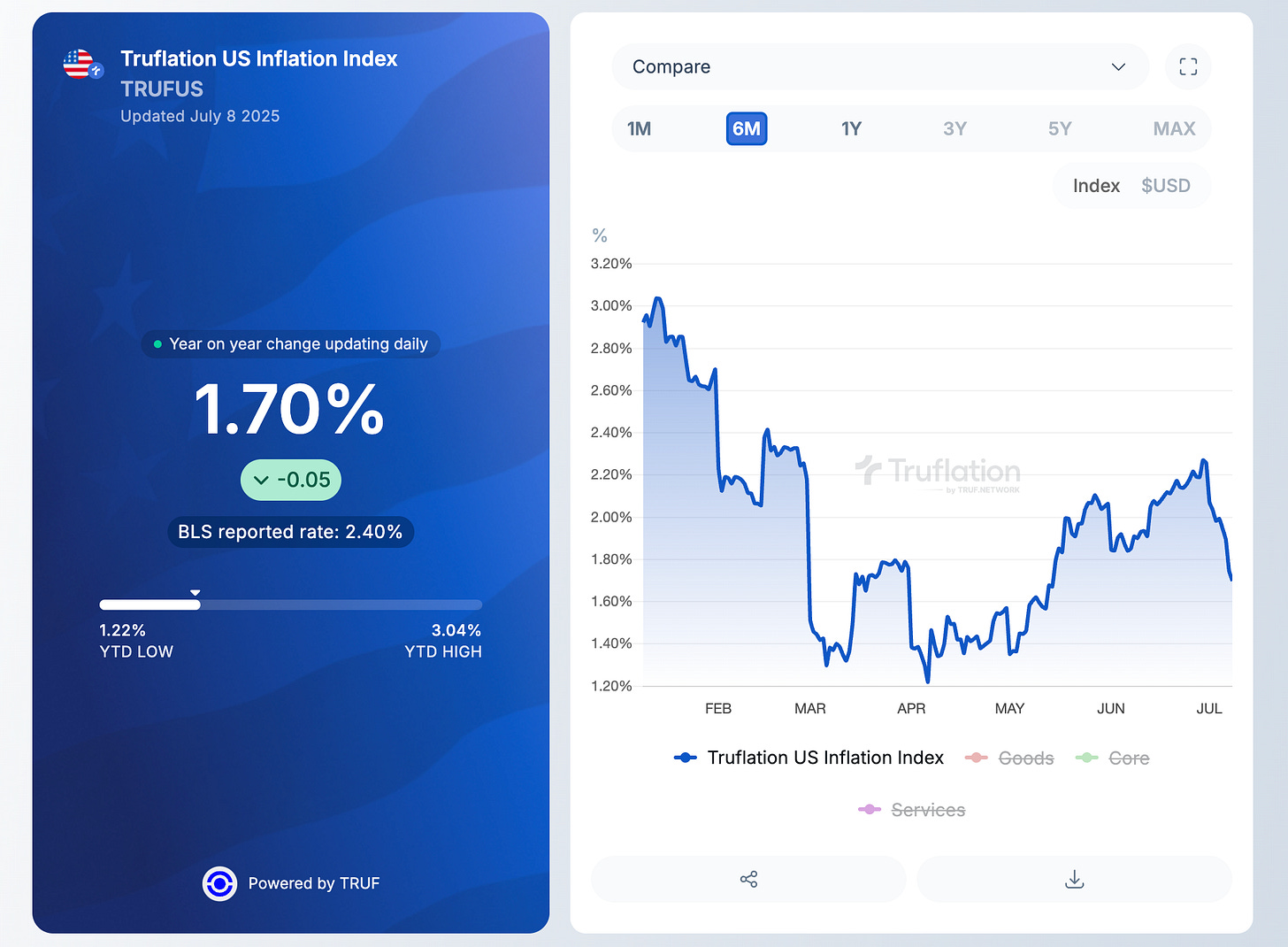

A bullish cocktail: inflation is lower than feared, and growth isn’t as stagnant as feared

The USD is dropping, and the whole world wants it even weaker

Trump and Bessent want a weaker USD to boost exports and domestic manufacturing, as well as to bolster markets.

The rest of the world wants a weaker USD so that they can stimulate to support their own struggling economies.

The USD is already down ~11% YTD, and it could very well keep going, especially if inflation stays muted or the Fed lowers rates.

The business cycle is coiled like a spring, and heating up

The more the USD weakens, the longer the business cycle has to run.

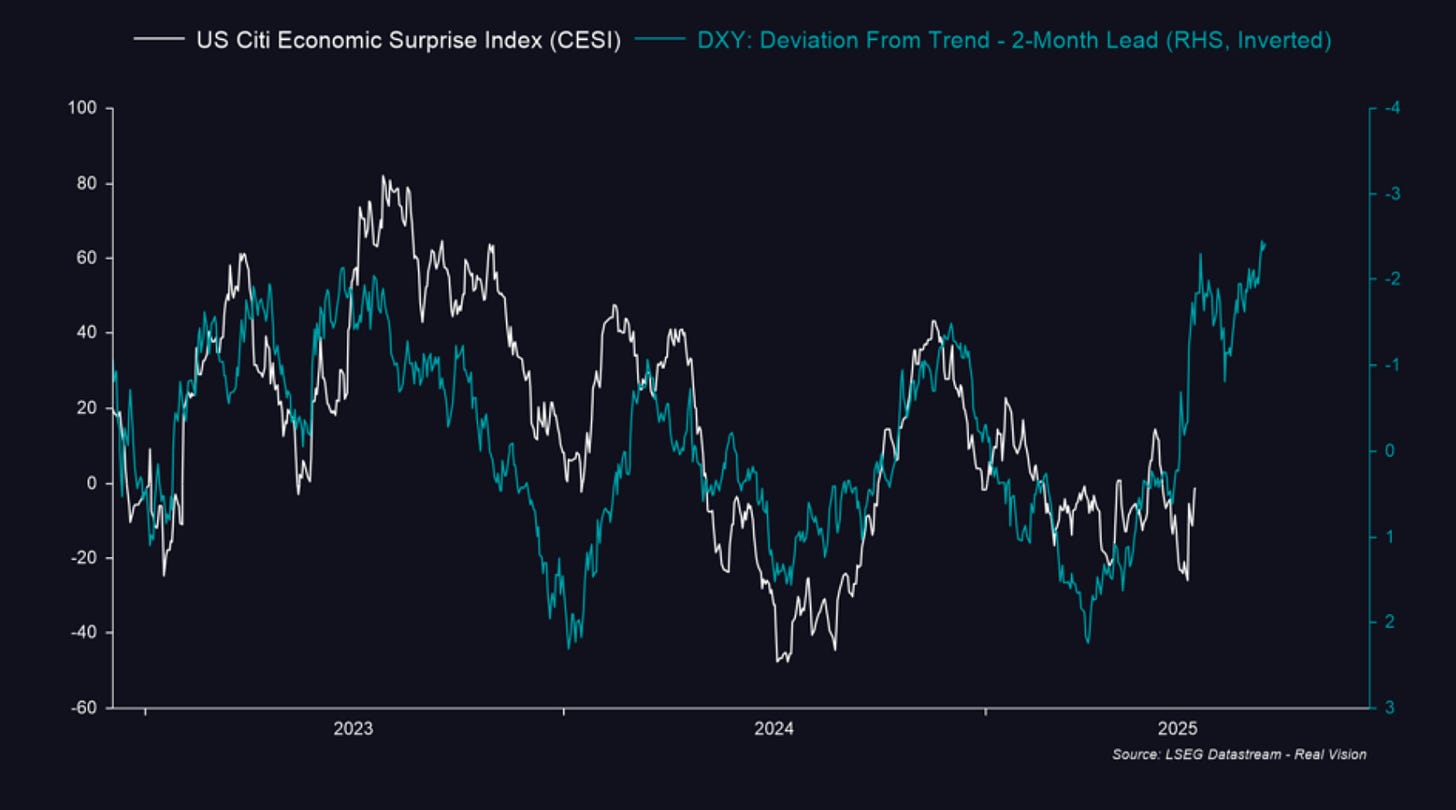

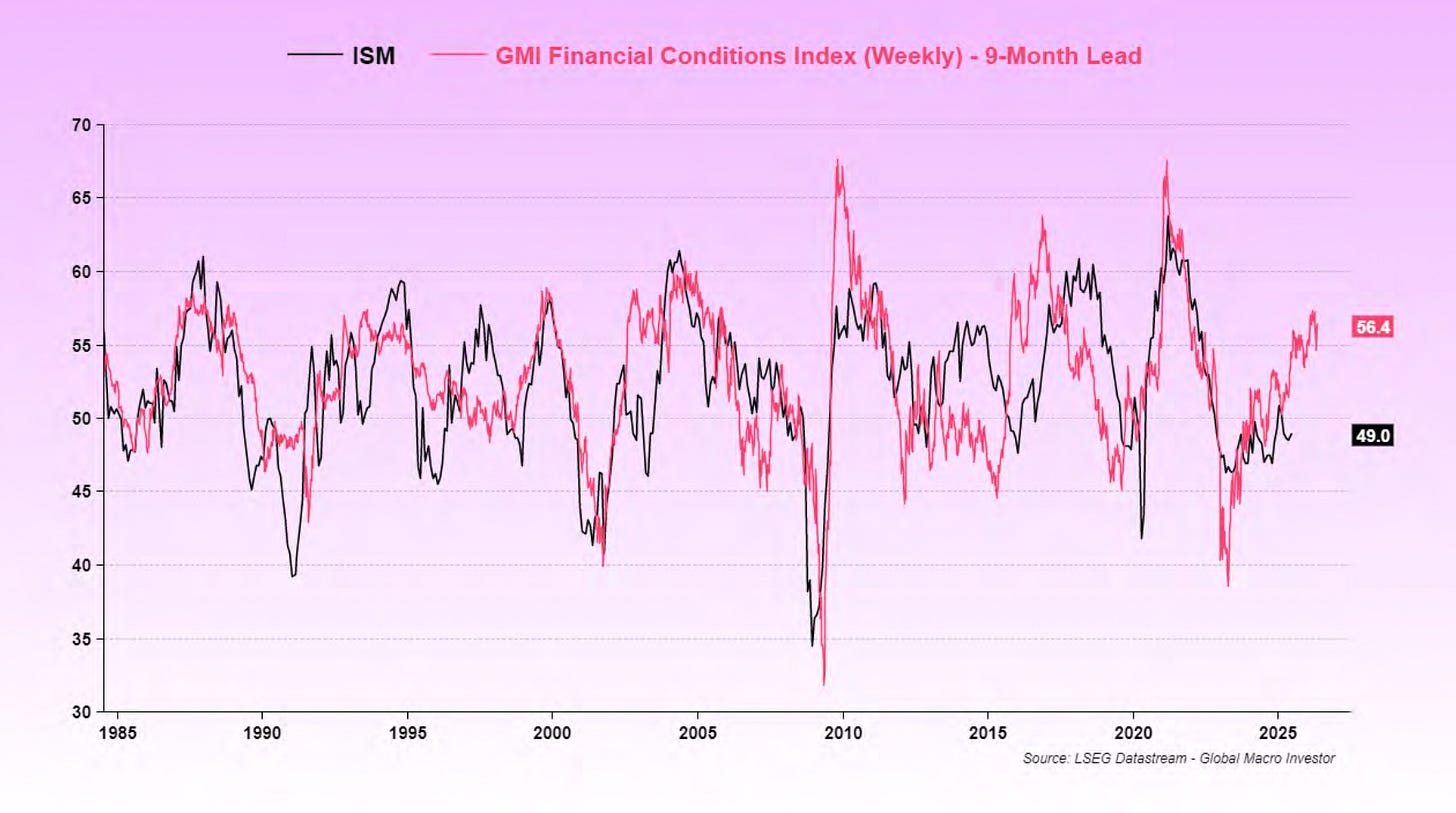

Remember - as we covered in April’s update, GMI’s research has shown us that financial conditions (a composite of the strength of the USD, oil prices, and rates) drive asset prices 6-9 months later.

And based on where we stand today, we’re already set up for the business cycle to extend into 2026 once it really heats up.

From GMI, regarding the USD weakening:

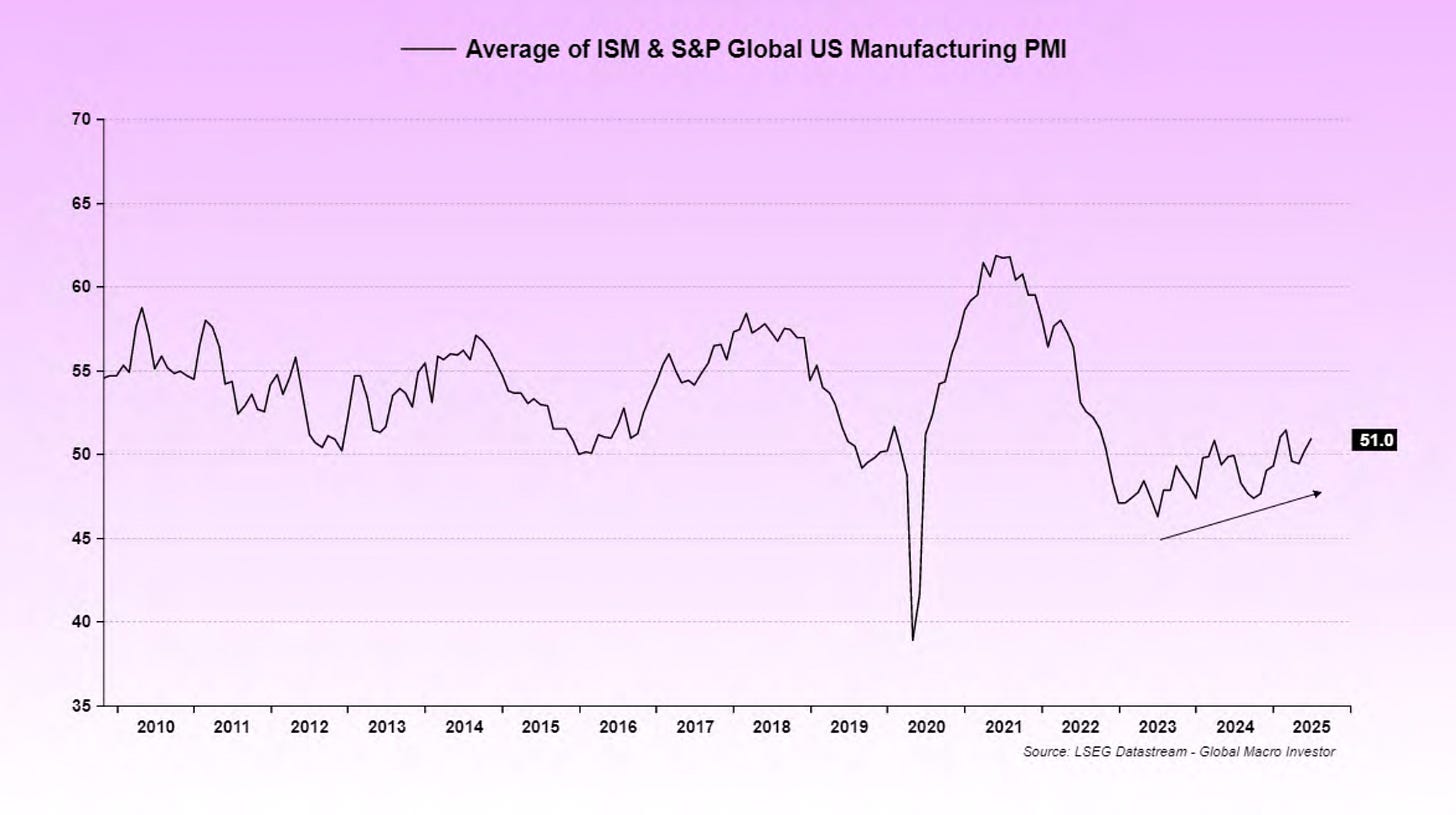

And this, much like what we saw back in 1987, is what will push the ISM higher – likely into Q2 of 2026, as things stand right now.

The more the dollar and rates come down today, the more room there is for the business cycle to extend further into next year.

The business cycle drives everything, but it drives BTC first.

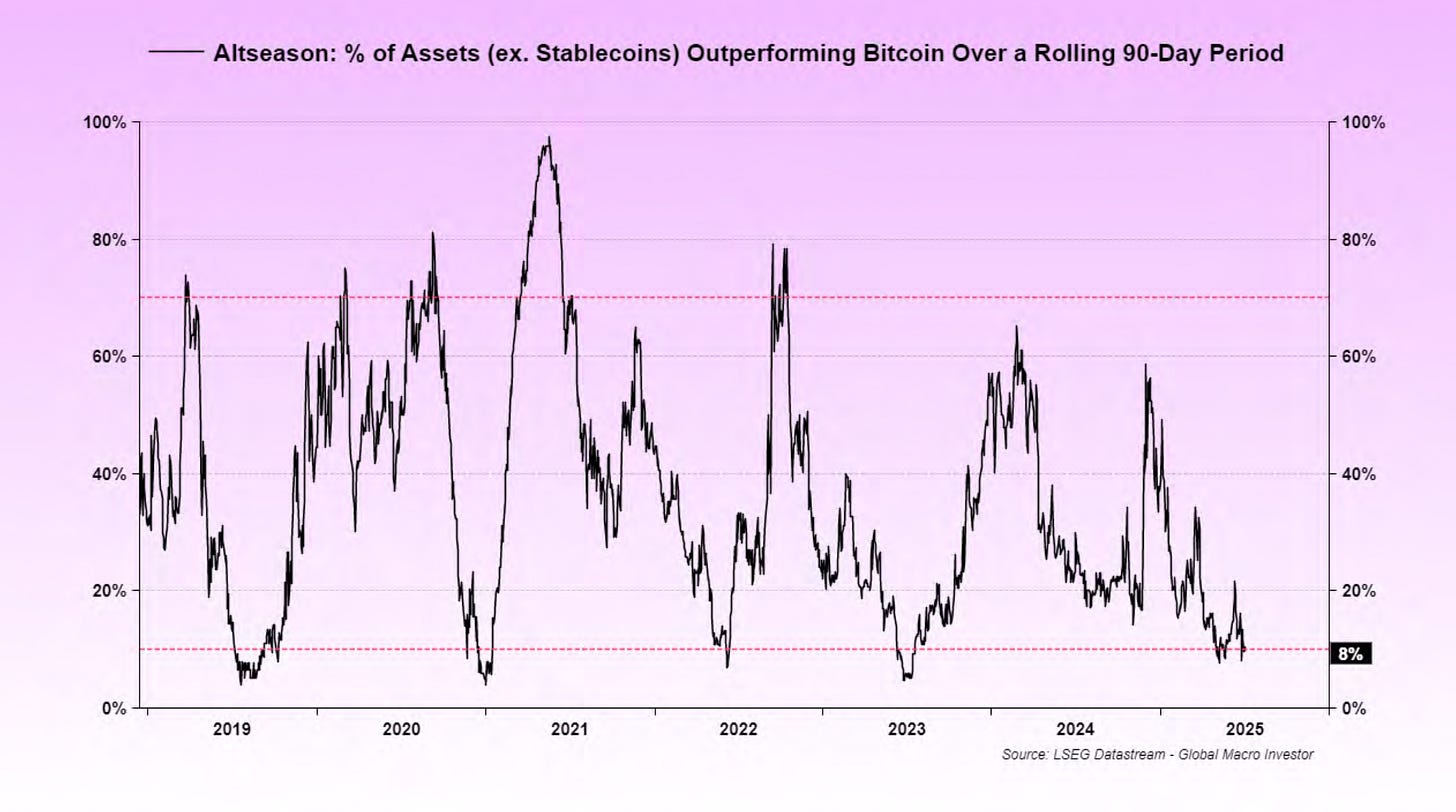

Alts will have their time as well - typically on a ~3-month lag after BTC.

And now, we’re seeing alts at dramatically oversold levels. We’re prepped for a swift move in our view - all we need is one catalyst. Maybe it’s the Fed cutting. Or the tariff agreements finally reaching finality. Or Trump naming his next Fed chair appointee.

Whatever it is, we’re coiled like a spring.

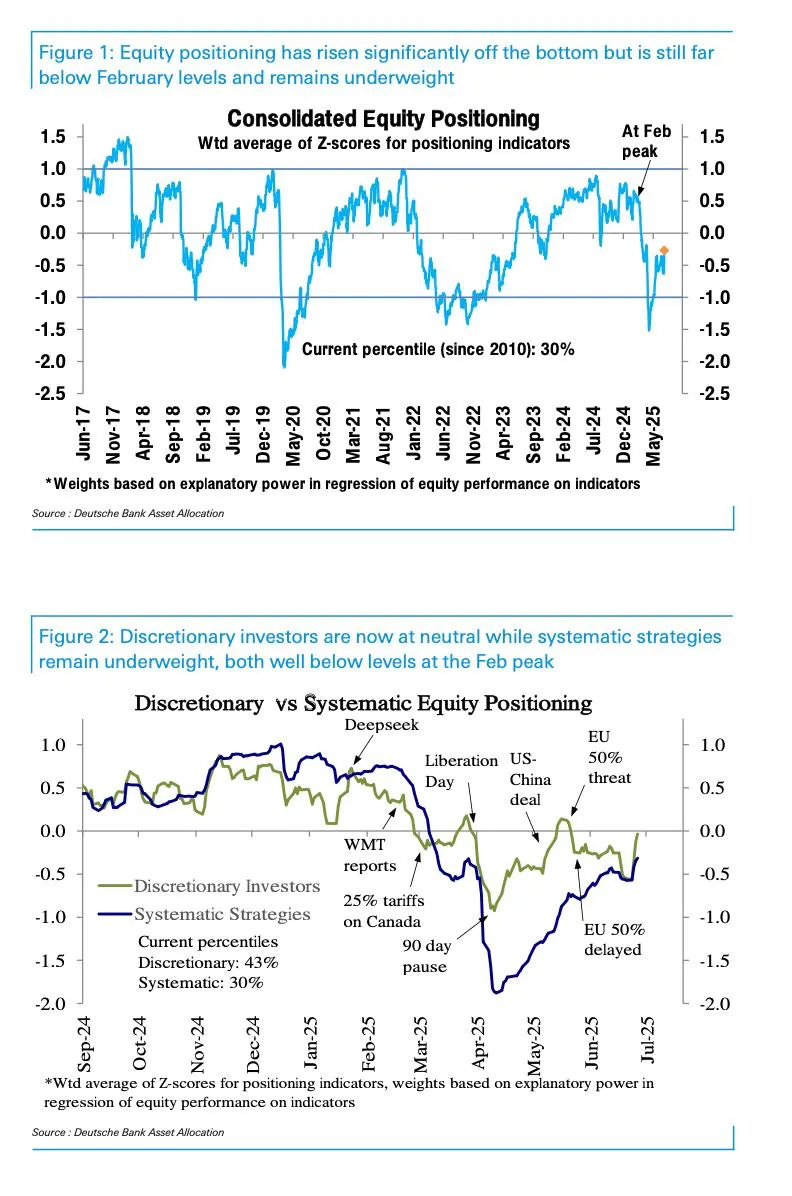

On top of all this, positioning is still offsides

As we said last month, there’s a massive disconnect between hard and soft data.

The market is still offsides relative to what the hard data is telling us.

Don’t fight the Fed (or the Treasury)

There’s a maxim that you should never fight the Fed.

It’s becoming clear that you shouldn’t fight the Treasury either.

At this point in time, they’re the ones doing more to ease financial conditions and inject more liquidity into the system to fund this runaway fiscal situation.

On top of this, we have a scenario where the Fed has less and less reason to keep rates at levels that they themselves have deemed “restrictive.”

We could have a scenario where we get dramatic monetary dovishness as well - with rates coming down, the SLR lowered (or even eliminated), and QT fully halted.

The answer: real assets + innovation

To recap:

We have a fiscal situation with only one way out: growth

We have a strong macro backdrop with the hard data that leads assets (particularly crypto) improving

We have positioning still offsides as soft data and FUD is clouding investors’ judgement

We have monetary policy in a place that could accelerate into easing

Don’t fight it.

Nothing stops this train.

It’s time to take the hint.

It’s time to own crypto.

It’s time for Comma.

Where are we in the crypto cycle?

🟢 Overall, I’d still give us a green light.

None of the 6 technical/valuation metrics below are in the warning zone.

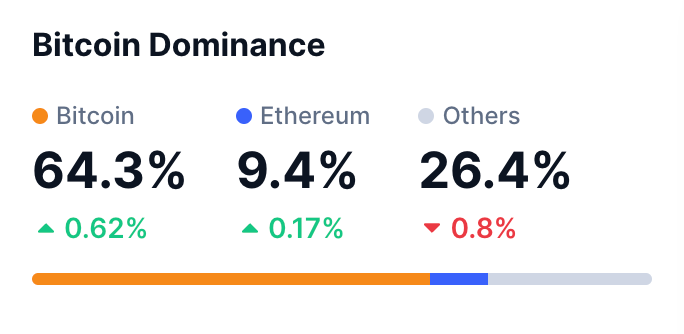

Bitcoin dominance

Currently: ~64%

Warning zone: ~45%-50% (bottomed ~40% last cycle)

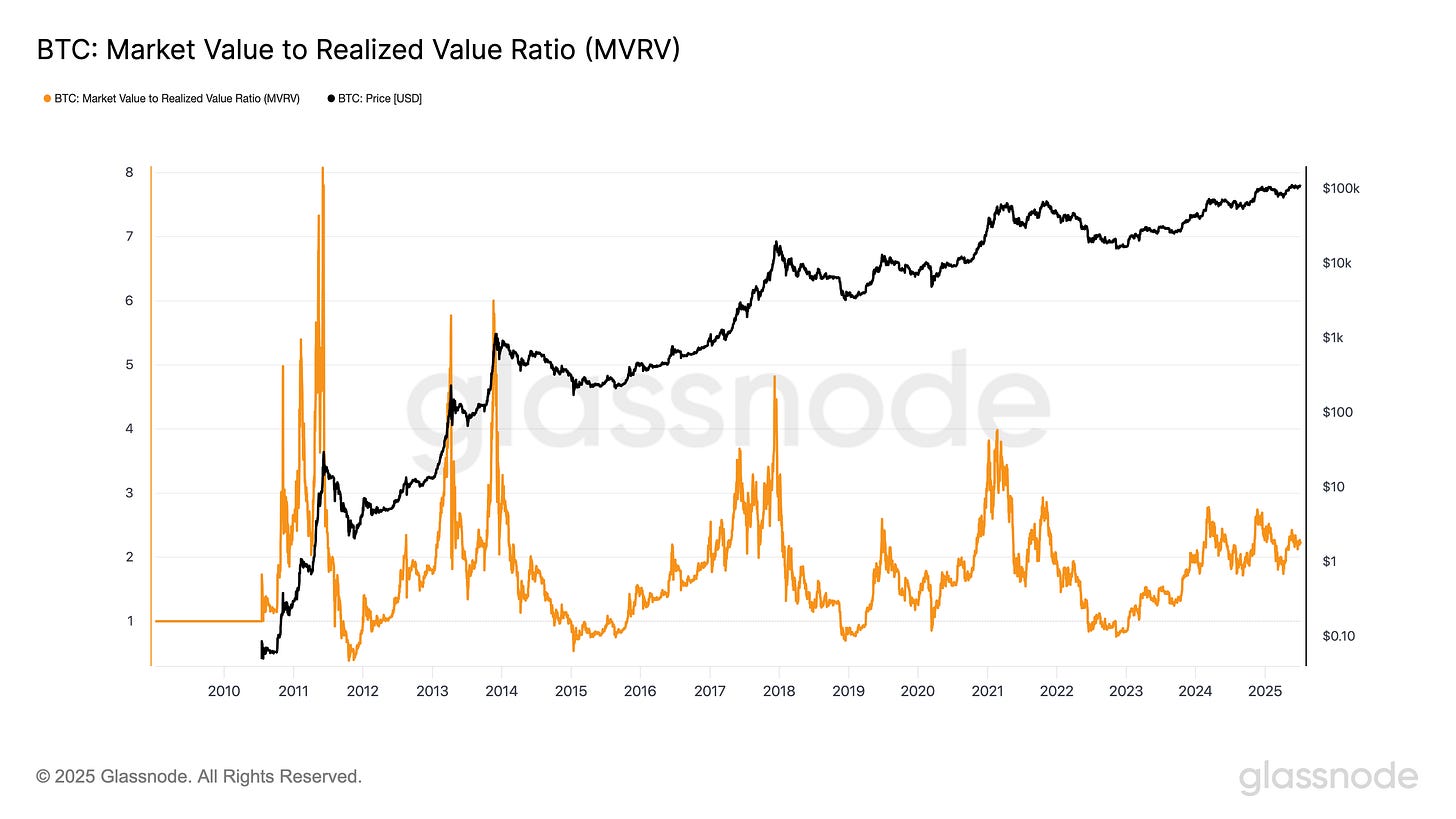

MVRV & Z-score

MVRV

Currently: ~2.2

Warning zone: ~3-3.5 (topped ~3.9 last cycle)

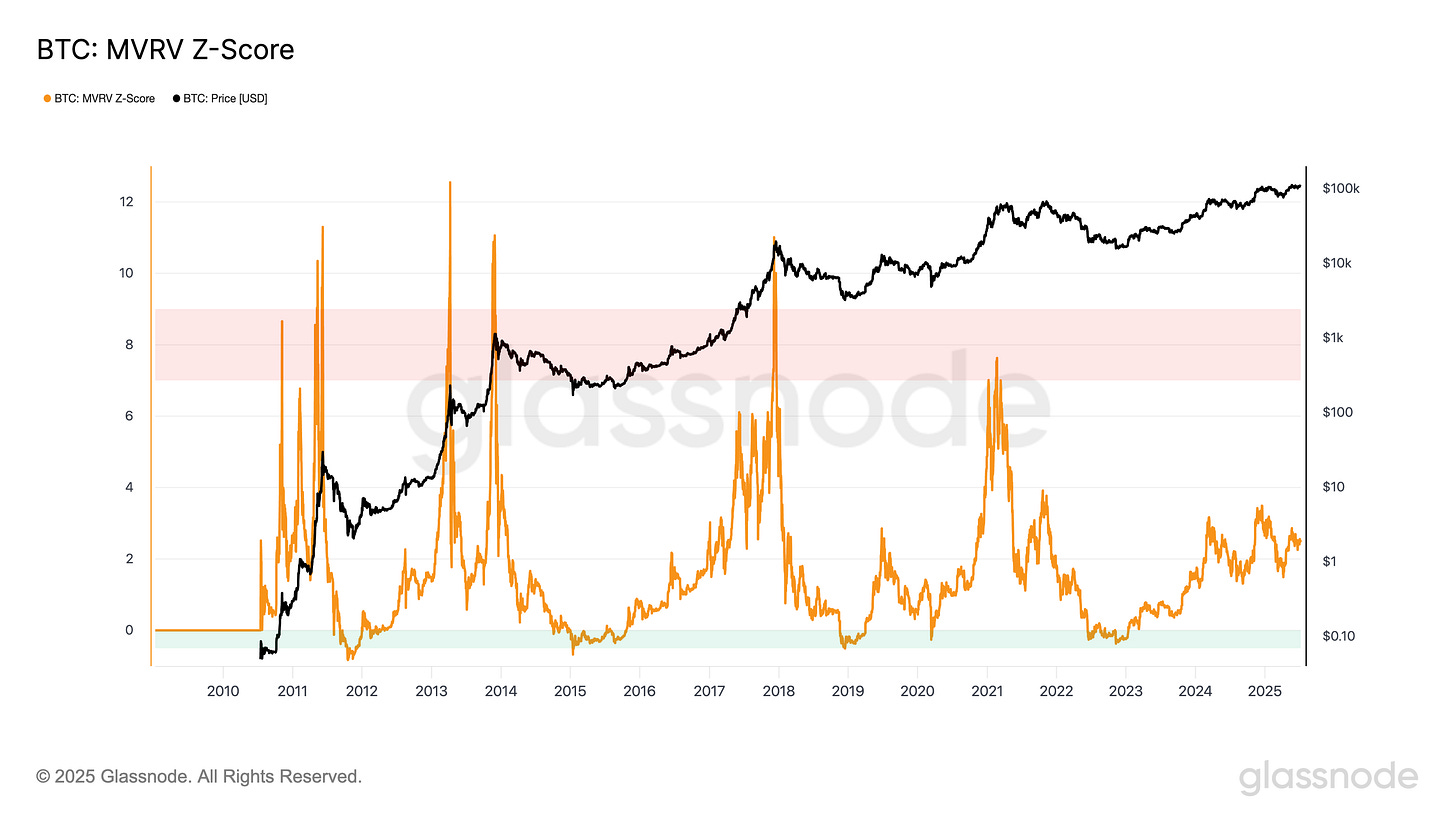

MVRV Z-score

Currently: ~2.5

Warning zone: ~6-7 (topped ~7.5 last cycle)

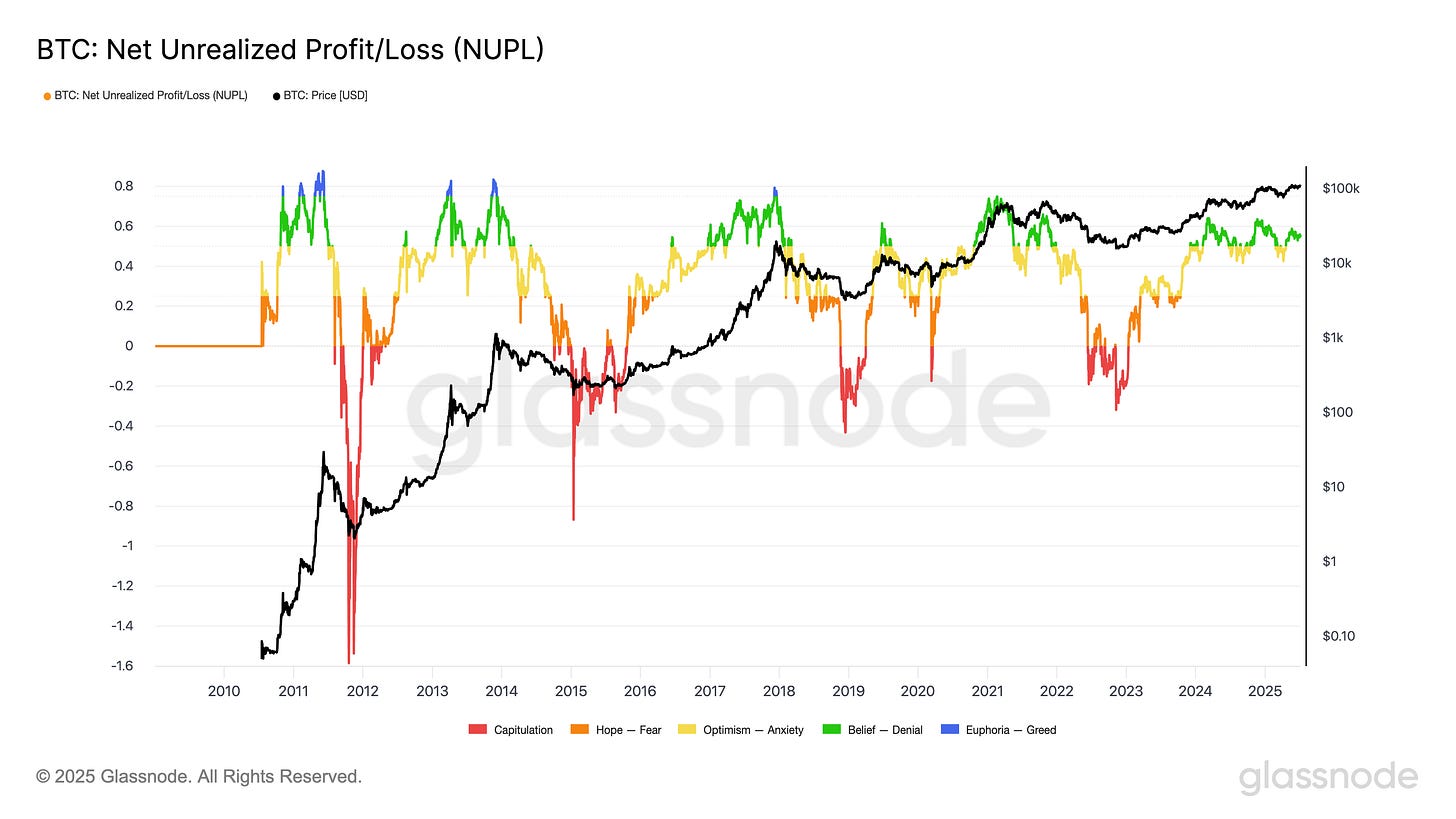

NUPL

Currently: ~0.55

Warning zone: ~0.6-0.7 (topped ~0.75 last cycle)

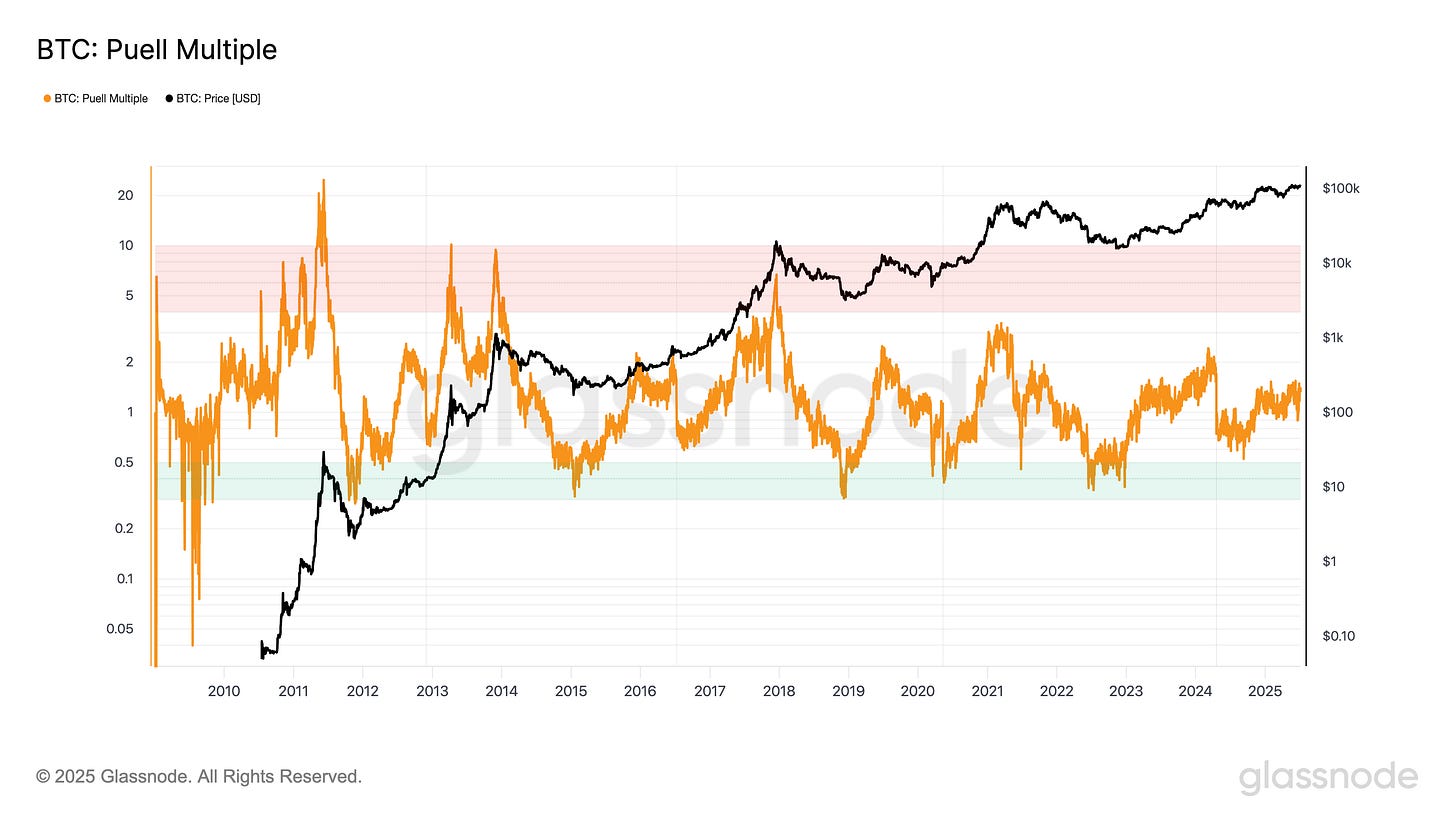

Puell multiple

Currently: ~1.32

Warning zone: ~2 (topped ~3.25 last cycle)

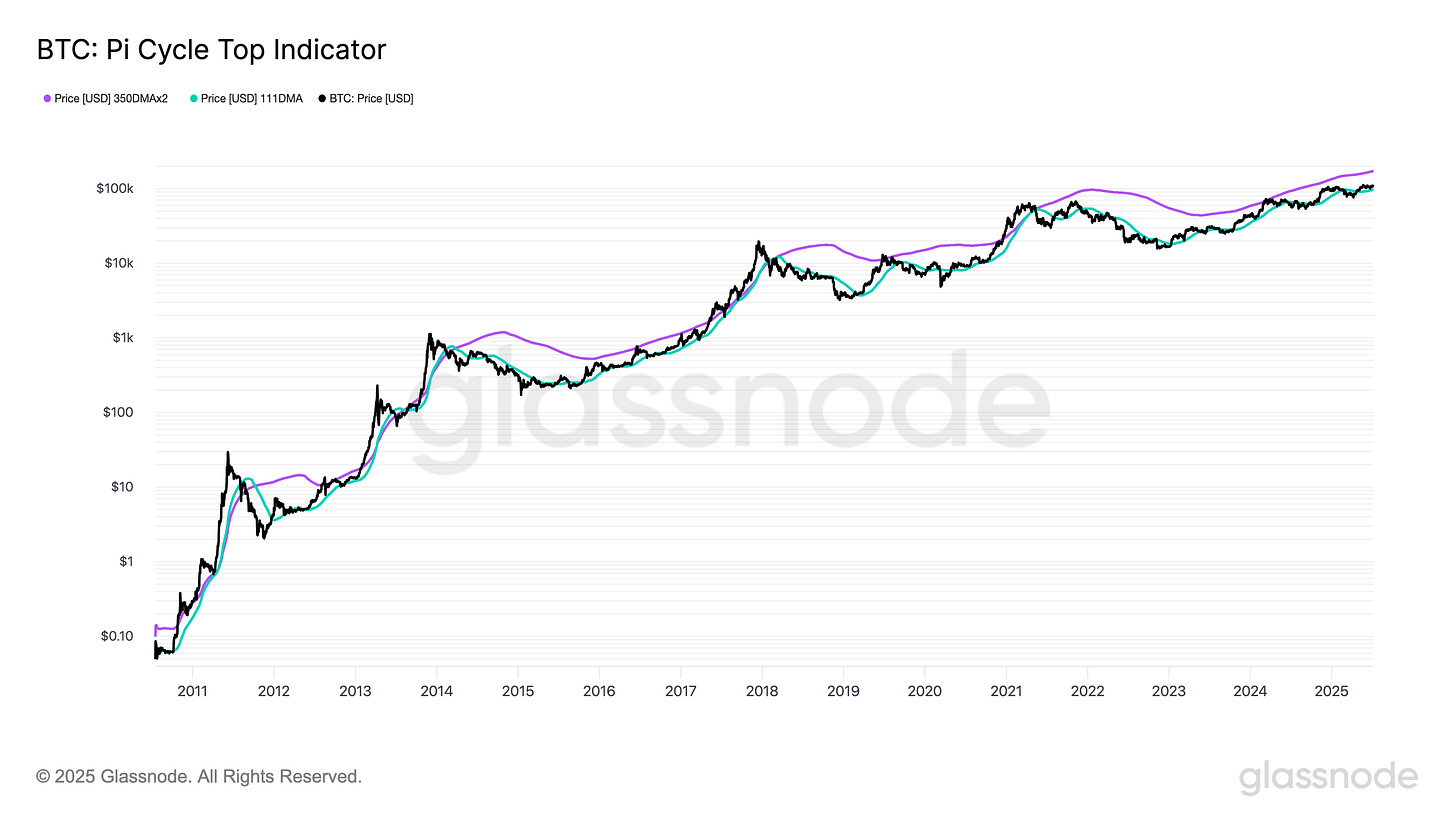

Pi cycle top indicator

Currently: not near a cross

Warning zone: when blue line approaches purple line

Some things I’ve been thinking about

Also all on Farcaster

Interesting reads, watches, listens

How Amsterdam invented capitalism

Brad Gerstner on Invest America

Founders Podcast on Michele Ferrero

Related things you might enjoy ⬇️

If you enjoyed this newsletter, forward it to a curious friend and tell them which idea they'd love.

Click here to watch and listen to spoken versions of essays, stories, and musings on YouTube.

To watch and listen on podcast apps:

Click here to read the archive.

Click here to follow on Twitter.

If you were forwarded this email, click the button below ⬇️ and enter your email to subscribe.