1️⃣1️⃣ Comma Partners: November 2024

The first officially unofficial Comma Partners update

Welcome to Comma Partners

A new-paradigm crypto fund investing at the frontier of

community, technology, culture, & capital

Welcome to the first officially unofficial update for Comma Partners.

I say official because, until now, I haven’t put my POV in any one place in any structured way with regularity. Starting now, I am doing so as I manage Comma’s portfolio.

I say unofficial because the fund hasn’t officially opened for business just yet. Things are underway, and I expect the fund to be live at the start of the new year. But as of now, there’s no outside capital yet.

Let’s get into it.

Oh yeah, and as you obviously know but I think I have to say it anyway - NONE OF THIS IS FINANCIAL ADVICE, DO YOUR OWN RESEARCH, ETC. ETC.

Current state-of-the-union

Things have heated up, to say the least.

For the month of November:

Crypto:

BTC +38%

ETH +44%

SOL +42%

Equities

S&P 500 +5%

NASDAQ +5%

Elections have been the main driver

Trump’s election was the main driving factor. He has been vocal in his support for crypto.

Other congressional races were overwhelmingly pro-crypto, with ~2/3 of those elected being advocates.

Why does this matter?

More regulatory clarity and freedom

This phrase has been uttered many times over the past month, but “the boot is off the neck” of the crypto industry.

We’re increasingly learning just how much the aggressively restrictive regulatory stance under the Biden & Gensler leadership has stifled innovation in the space, and therefore outlook - and prices with it.

More permissive regulation, and increased regulatory clarity, expected over the next four years seems like it may be a virtuous cycle.

More freedom to build and more clarity around how to build in compliance with the rules → more willingness to build → more exciting possibilities → more people wanting to build → more building → more progress → more favorable regulatory stance → rinse and repeat.

Less friction and limitations on the ecosystem, especially in an open-source and interoperable system like crypto, results in exponentially more opportunity and progress.

It seems that this step-change upward in medium-term possible outcomes has led Mr. Market to see more value in crypto, today and in the future.

I agree with Mr. Market.

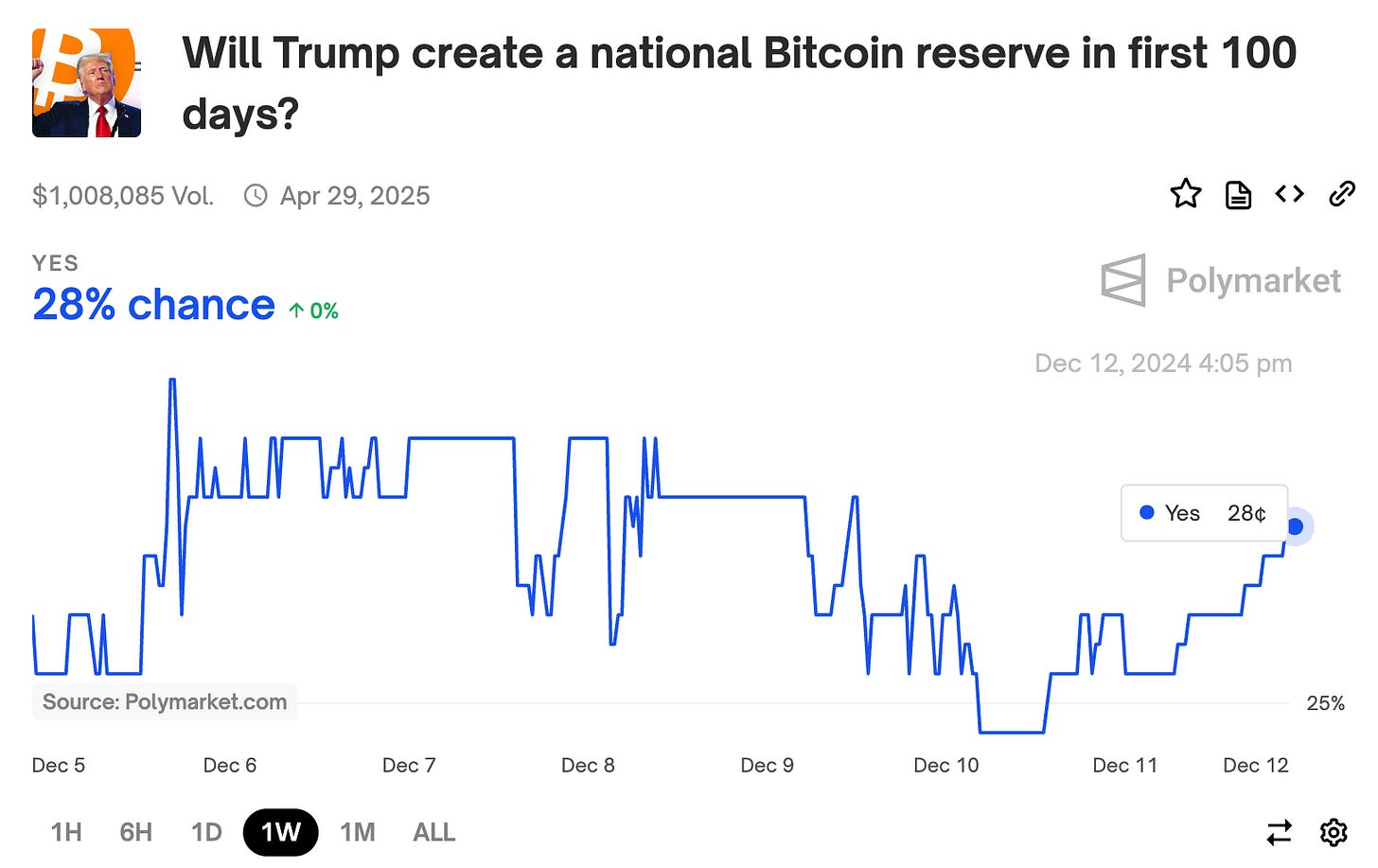

Possibility of a national strategic Bitcoin reserve

Explicit statements have been made by Trump, Senator Lummis, and others, advocating for the US Treasury to acquire Bitcoin (Senator Lummis’s BITCOIN Act of 2024 proposed acquiring 1 million BTC (~5% of supply) over 5 years).

Beyond the simple math of the potential of a new massive long-term buyer, this has also served to legitimize crypto as an industry and asset.

It also sparks a Prisoner’s Dilemma for all other nations, giving others incentive to front-run the US by buying now, before the US starts buying and drives price up, or to pay the steep price as a fast-follower.

By no means is this a certainty. Polymarket gives it a 28% chance.

But any odds above zero are bullish.

How about macro & liquidity?

Generally speaking, over the last handful of weeks, global M2 has been declining.

Based on the chart below, it suggests that in the short-term (say, through year-end), there may only be room for another ~5%-10% move upward in BTC (~$110K), with a chance of an ~20%-30% correction.

This week’s flush

Starting late Sunday night into Monday morning (~12/9), we had a short but dramatic market-wide tumble across all risk assets that reversed course late Tuesday (12/10). BTC, ETH, and SOL dropped ~7%, ~12%, and ~13% respectively, with the S&P and NASDAQ both down ~1% as well.

As we can see from the funding rate heat map and open interest totals, this sudden fall seemed to be fueled by a flushing of leverage out of the system. We’re at a much healthier level now, which sets us up with less risk in the system generally speaking.

In my opinion, this week’s flush brings down the odds of a more dramatic 20%-30% correction telegraphed by the liquidity indicators.

Still possible, but less likely.

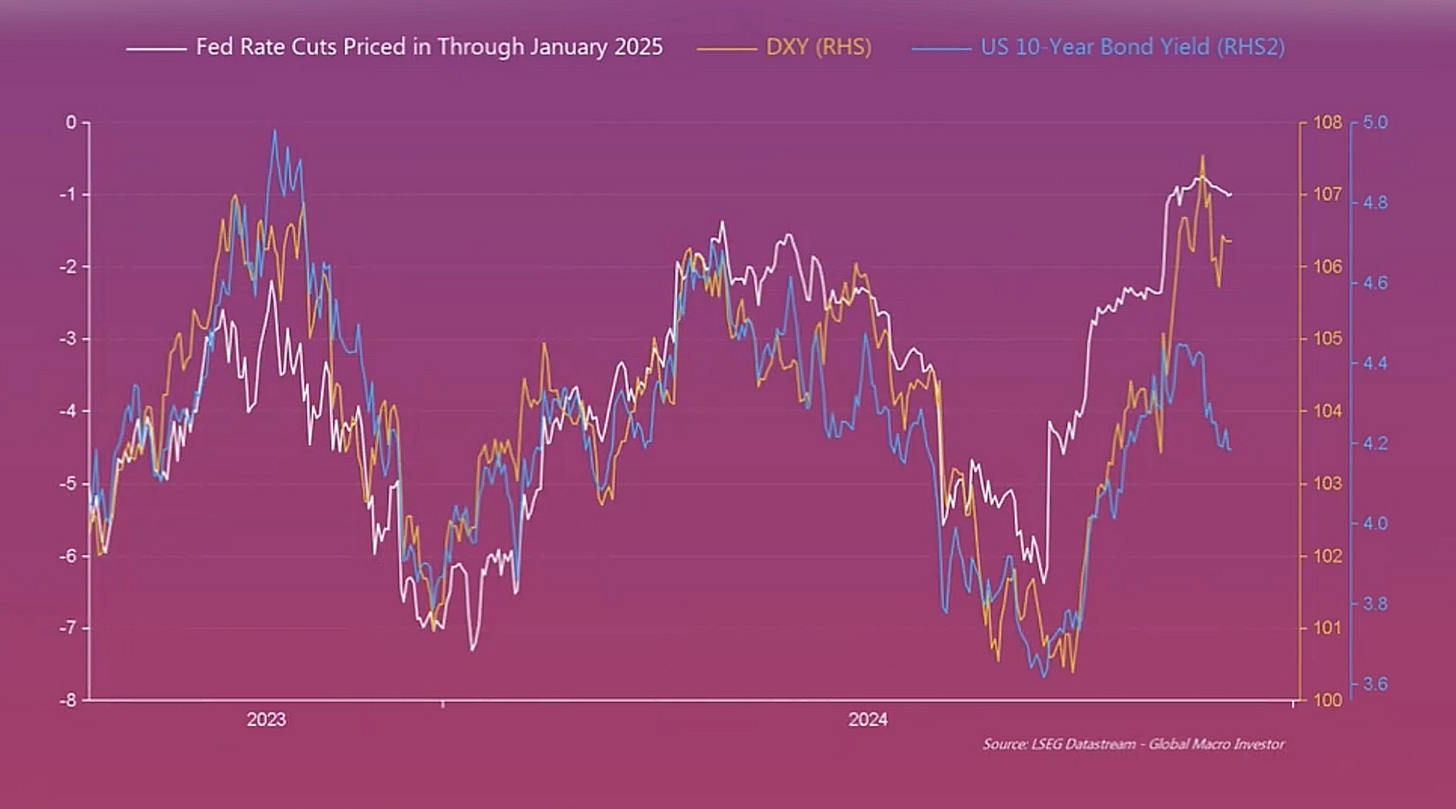

The outlook for liquidity

Other signals are showing some weakness in the economy, suggesting we should get another rate next week, a weaker USD, and liquidity rising again.

Trump’s stance generally is in pursuit of a weaker USD as well.

See these quotes from RealVision’s Macro Investing Tool report (my favorite source of macro signal as it relates to risk assets, and specifically crypto):

...a weaker dollar isn’t just about a lower DXY. It’s about improving global liquidity. As dollar-denominated debt becomes easier to service, it unlocks a massive pool of liquidity that can then, in theory, be financialized.

The dollar’s movements set the tone for global liquidity, unlocking or tightening the flow of capital, shaping the macro landscape, and setting the stage for what comes next.

This leads me to remain bullish over the medium- and long-term.

This would also be consistent with what happened the last time Trump was elected.

The USD rose after the 2016 election, M2 pulled back, then liquidity steadily rose through 2017. The same thing happened after the 2020 election.

After Trump’s election in 2016, BTC surged through year-end, followed by an ~30% drawdown in January, then a rocketing upward, going ~23x from its low in January through 2017.

Given our massive national debt load (~$36T) and skyrocketing interest payments (over $1T annually, more than our $900B defense budget for 2025!!), my view is that the US has no choice but to continue debasing the USD and lower interest rates to make this situation even remotely sustainable.

That is, until AI and robots develop enough to drive real GDP growth in any material way, which I think is a real likelihood, but one that we’re still several years away from.

(As an interesting historical aside, I heard an analog that I really liked. The period of peace and US prosperity post-WWII led to a wave of optimism that resulted in the Baby Boomer generation - a massive uptick in population growth (and therefore the workforce) that drove unprecedented GDP growth. While we have demographic challenges with an aging and declining workforce today, AI and robots stand to be our pseudo-population increase as billions of non-human actors start acting as our productive “army” in the workforce.)

This also leads me to remain bullish over the medium- and long-term.

I think any further weakness or pullback we see in the coming weeks (if one does indeed come) is only temporary.

Let’s get in to some of the specific signals I mentioned above.

Business cycle: ISM business health indicators

The ISM (Institute of Supply Management, which surveys businesses about business health), showed weakness - especially in the services sector. The ISM’s November PMI (purchasing manager’s index - the survey itself) came in below expectations.

This is critical for the Fed’s decision-making process, since services account for ~90% of the US economy.

Weaker services sector → increased odds of a rate cut.

What’s interesting is that this ISM weakness comes alongside forward-looking optimism as the Regional Fed Surveys are showing an uptick in the 6-month outlook for new orders.

Optimistic future outlook → good for risk assets.

We see this below. As the ISM picks up, so does the outperformance of risk assets. If the forward-looking optimism translates, we could see “alt season” on the horizon.

Business cycle: unemployment

Unemployment came in at 4.2% for November, up slightly from 4.1% in October.

Jobless claims also came in higher than expected for November.

Weaker employment → increased odds of a rate cut.

The market is increasingly convinced a 25 bps rate cut is coming December 18th.

Polymarket odds of a December rate cut jumped dramatically in response to this data.

(Another aside: Polymarket is really changing the game. I find I’m increasingly turning to them, not just for overall predictions, but for shift in market sentiment in real-time. Their odds jumped immediately upon the release of the unemployment data at 8:30am sharp, then again upon the release of the inflation data. I was following Polymarket like a hawk throughout the election, and am of the firm belief that these prediction markets, when highly liquid, are higher-signal sources of insight.)

Business cycle: inflation

The other half of the Fed’s mandate (inflation) seems to be less relevant at the moment, as it’s been in a general downward trend, and real rates (net of inflation) are historically pretty high.

That said, CPI ticked up in slightly in November, but it was still in line with expectations.

If it had come in materially higher than expected, it could have kept the Fed more cautious about continuing to drop rates.

But, it didn’t, and, once again, it left the market increasingly convinced of a 25 bps rate cut. The odds once again jumped dramatically after the data release.

Monetary policy: Fed rate decision

So, all together, it’s looking like we’ll get another 25 bps rate cute on December 18th, with Polymarket odds at ~95%.

After that, it seems like we’ll get a pause - or a “skip,” using the Fed’s language. Though we’ve started seeing some weakness on the margin, the economy is still looking pretty resilient with rates where they are. Inflation is also a bit sticky.

But looking ahead into 2025, with a Trump presidency looking like it will keep adding to the deficit, and therefore our debt load, my guess is that liquidity continues to pump.

This, too, leads me to remain bullish over the medium- and long-term.

Some more charts worth taking a look at:

Where are we in the cycle?

🟢 Overall, I’d give us a green light.

Only 1 of the 6 technical/valuation metrics below are in the yellow zone.

We’re heating up, no doubt, but I still believe this is the time to be max risk, especially against the macro backdrop, combined with the broader step change in possibilities for the industry that come with Trump coming into office in January.

Bitcoin dominance

Currently: ~55%

Warning zone: ~45%-50% (bottomed ~40% last cycle)

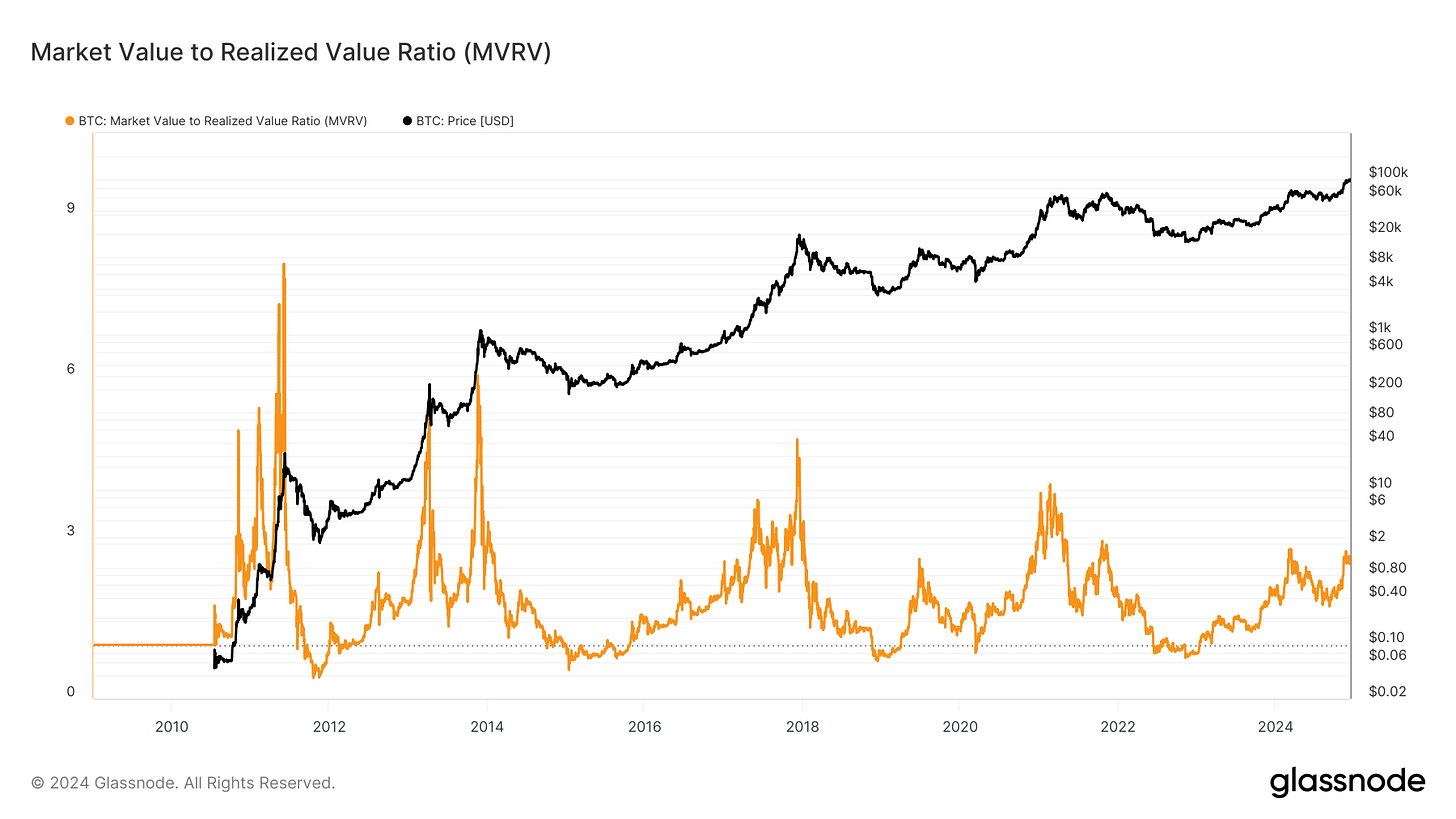

MVRV & Z-score

MVRV

Currently: ~2.6

Warning zone: ~3-3.5 (topped ~3.9 last cycle)

MVRV Z-score

Currently: ~3.2

Warning zone: ~6-7 (topped ~7.5 last cycle)

NUPL

Currently: ~0.6

Warning zone: ~0.6-0.7 (topped ~0.75 last cycle)

Puell multiple

Currently: ~1.2

Warning zone: ~2 (topped ~3.25 last cycle)

Pi cycle top indicator

Currently: not near a cross

Warning zone: when blue line approaches purple line

Some things I’ve been thinking about

Also all on Farcaster

Interesting reads, watches, listens

Why are we here? From web1 to web3

Bitwise’s top 10 crypto predictions for 2025

Best series of the most exciting developments of the last month (in my opinion): crypto x AI agents:

Micky Malka on Invest Like the Best

Current crypto commentary vis-à-vis liquidity

Related things you might enjoy ⬇️

If you enjoyed this newsletter, forward it to a curious friend and tell them which idea they'd love.

Click here to watch and listen to spoken versions of essays, stories, and musings on YouTube.

To watch and listen on podcast apps:

Click here to read the archive.

Click here to follow on Twitter.

If you were forwarded this email, click the button below ⬇️ and enter your email to subscribe.