8️⃣ Comma Partners: August 2025

A Jackson Hole pivot: rate cuts into an accelerating economy

Welcome to Comma Partners

A new-paradigm crypto fund investing at the frontier of

community, technology, culture, & capital

So far this year, the story has been all fiscal, all the time.

The main drivers of markets broadly and crypto more specifically have come from policy decisions out of the White House.

Liberation Day tariffs and resulting trade deals

The OBBBA - our new tax and spending bill

New pro-crypto regulation - the GENIUS and CLARITY Acts, the SEC’s “Project Crypto”

So far, the Fed has stayed put, keeping rates steady since December 2024.

This month, however, all eyes are on the Fed. The monetary side looks as though it is starting to catch up to the fiscal side.

We see a (still) very attractive setup:

An accelerating economy

Continued upside surprises

Easing financial conditions and more liquidity

Positioning is still offsides

State-of-the-union

For the month of August:

Crypto:

BTC (-6%)

ETH +19%

SOL +18%

COIN50 +3%

Equities:

S&P 500 +3%

NASDAQ +1%

Gold:

Gold +5%

The Fed & the economy

August was a very consequential month for the Fed, driven in particular by two key moments:

Their Jackson Hole Symposium and Powell’s statements made there,

followed by last week’s jobs report.

Jackson Hole

Throughout the year, inflation fears have been driving the Fed to keep rates at levels that even they have called “restrictive.”

Since March, core CPI has ticked up slightly from ~2.8% to ~3.1% in July.

All the while, the debate has been raging over whether Liberation Day tariffs will result in materially sustained inflation.

These fears, and the fact that inflation has remained above their 2% target have resulted in the Fed opting to “wait and see.”

Enter Powell at Jackson Hole.

On August 22nd in his Jackson Hole address, Powell articulated what econ and crypto Twitter have deemed the “Jackson Hole pivot,” from a primary focus on inflation fears to a primary focus on downside risks to the labor market.

Remember that the Fed has two prongs to its mandate: low and stable inflation, and maximum employment.

Powell highlighted several important things:

On the margin, downside risks to employment are rising

That the shifting balance of risks “may warrant adjusting policy”

That their base case is that the tariff impact on inflation will be short-lived

The market took this shift in narrative as a signal that rate cuts are here.

August’s labor market report

This stated shift in focus to leaning towards supporting the labor market was followed by what is by any measure a very weak set of data.

Job openings came in well below expectations and prior figures were revised dramatically down.

This resulted in June showing a first net loss in jobs since 2020.

The unemployment rate ticked up to 4.3%.

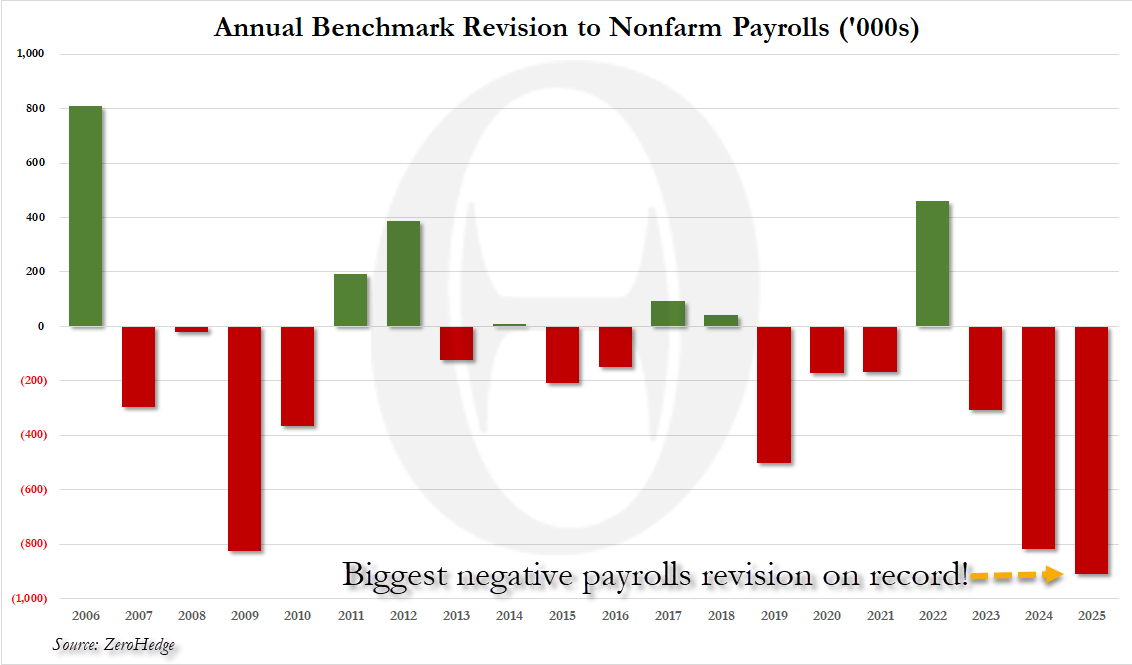

Then, today, the Bureau of Labor Statistics revised the non-farm payroll job additions for the 12-month period ending March 2025 down by -911,000 jobs - the largest negative revision on record.

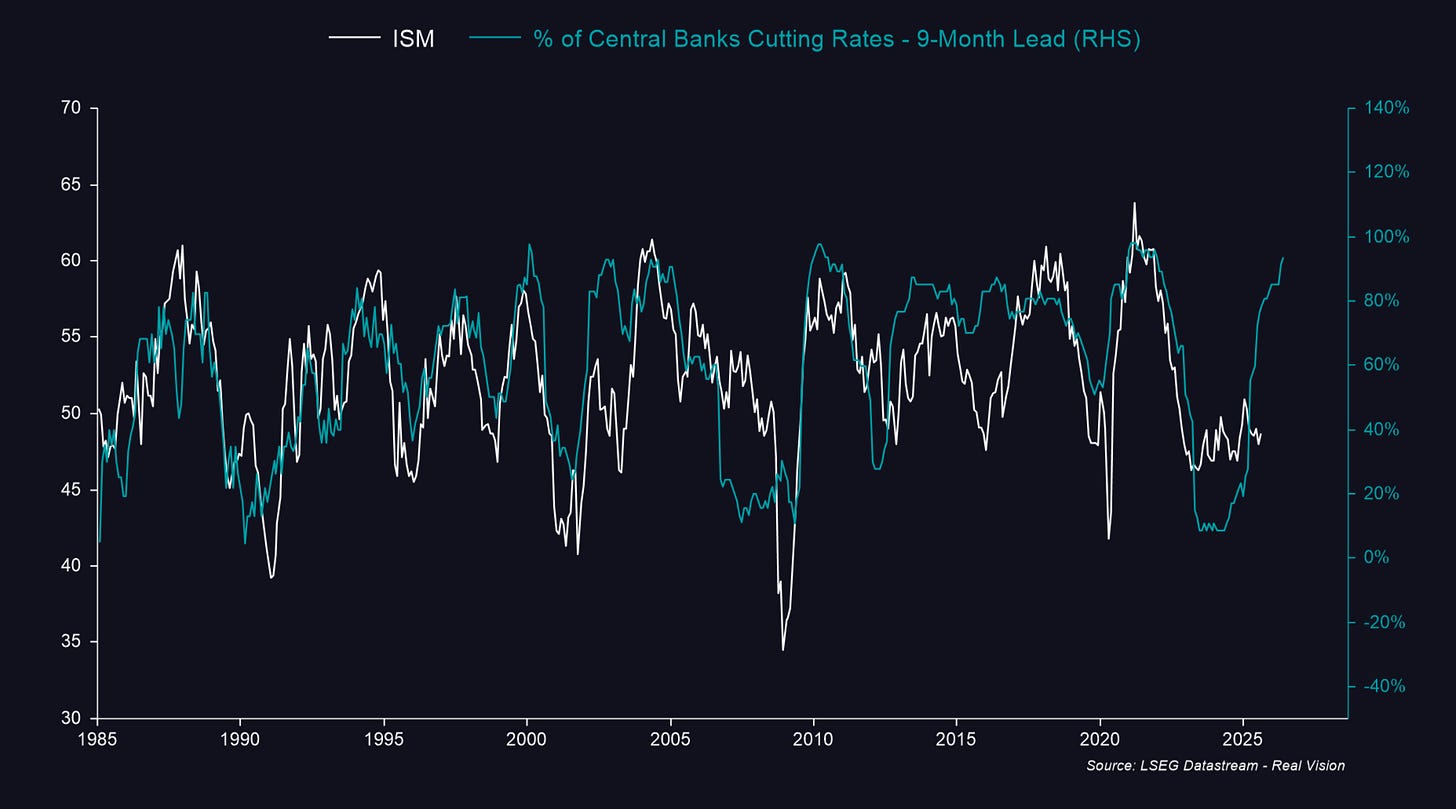

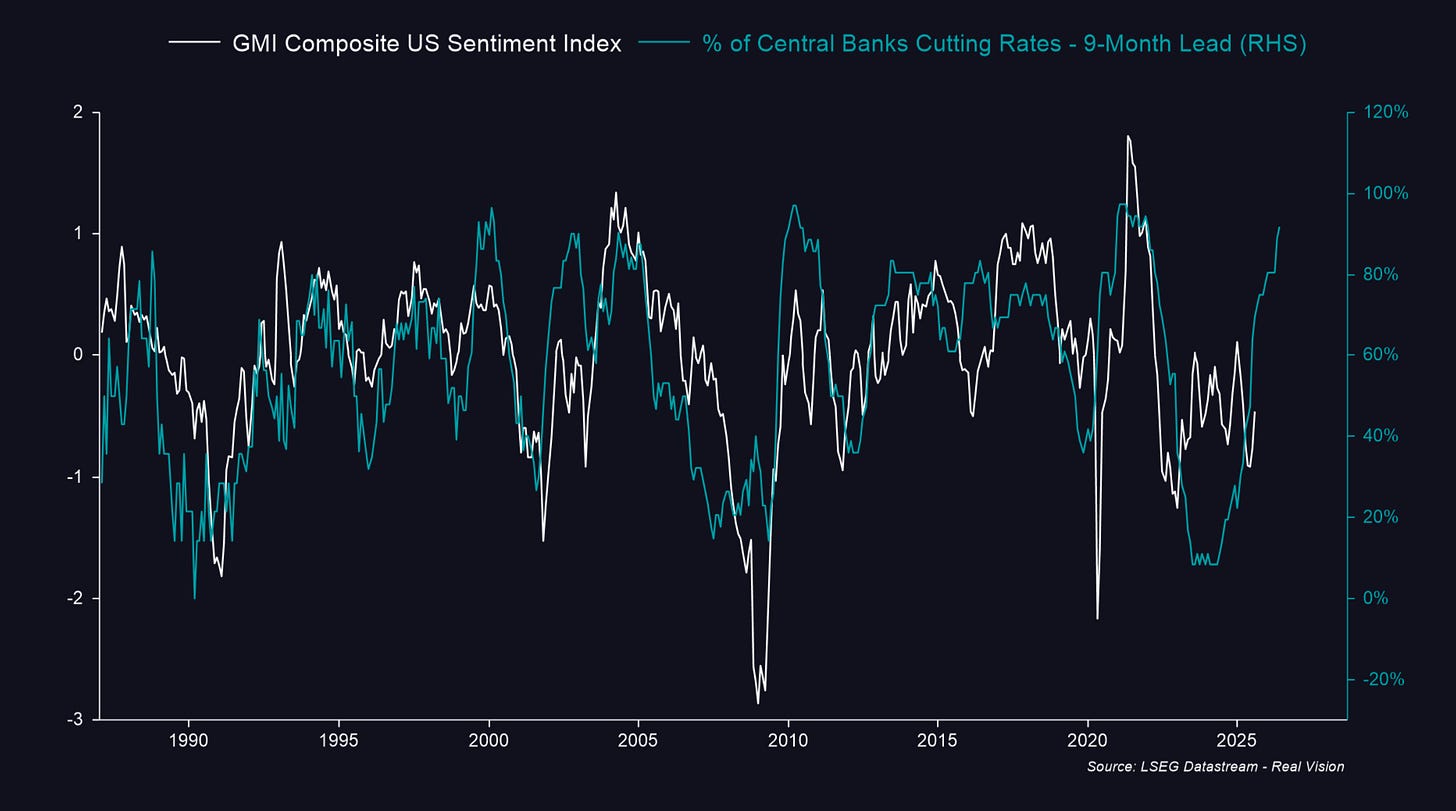

As a result, the market is now expecting a 96% chance of a rate cut on September 17th, with 75bps and 125bps of total cuts priced in through the end of the year and 2026 respectively.

From Darius Dale & 42Macro:

Thursday’s August inflation report will be an important piece of this rates puzzle. But even a slightly worsening inflation picture shouldn’t prevent the Fed from cutting next week.

Growth vs. inflation

All the attention recently has been on inflation re-accelerating.

There’s not enough focus on growth re-accelerating - in the US and in Europe.

The market is paying attention to the wrong thing.

Even if we get a slightly increasing inflation print on Thursday, I believe the inflation story is largely behind us, and the re-accelerating growth story is really the one we should be paying attention to.

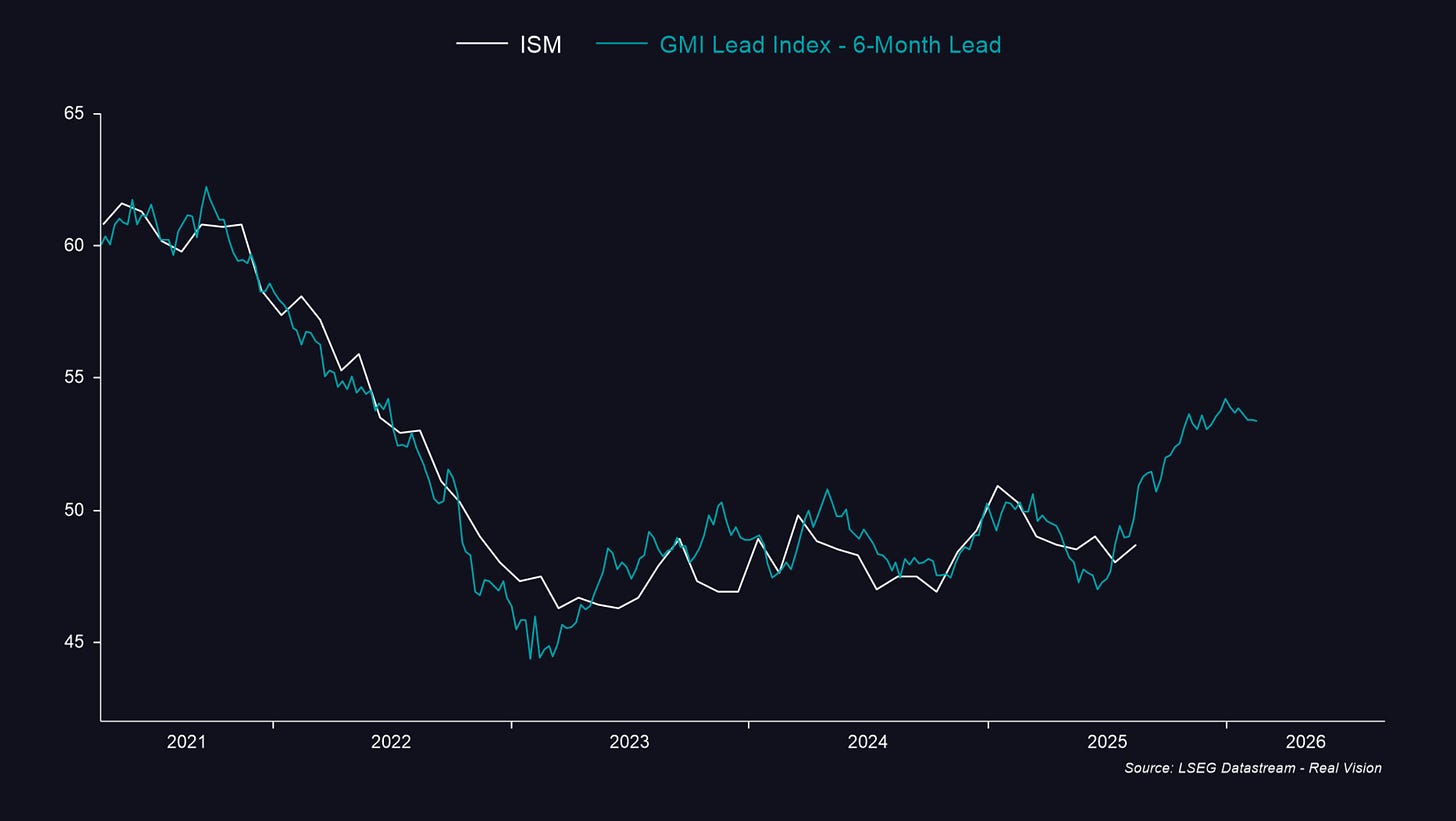

On the margin, the story in the economy right now should be about re-accelerating growth.

In fact, Truflation is showing inflation coming back down, once again below 2%.

Growth

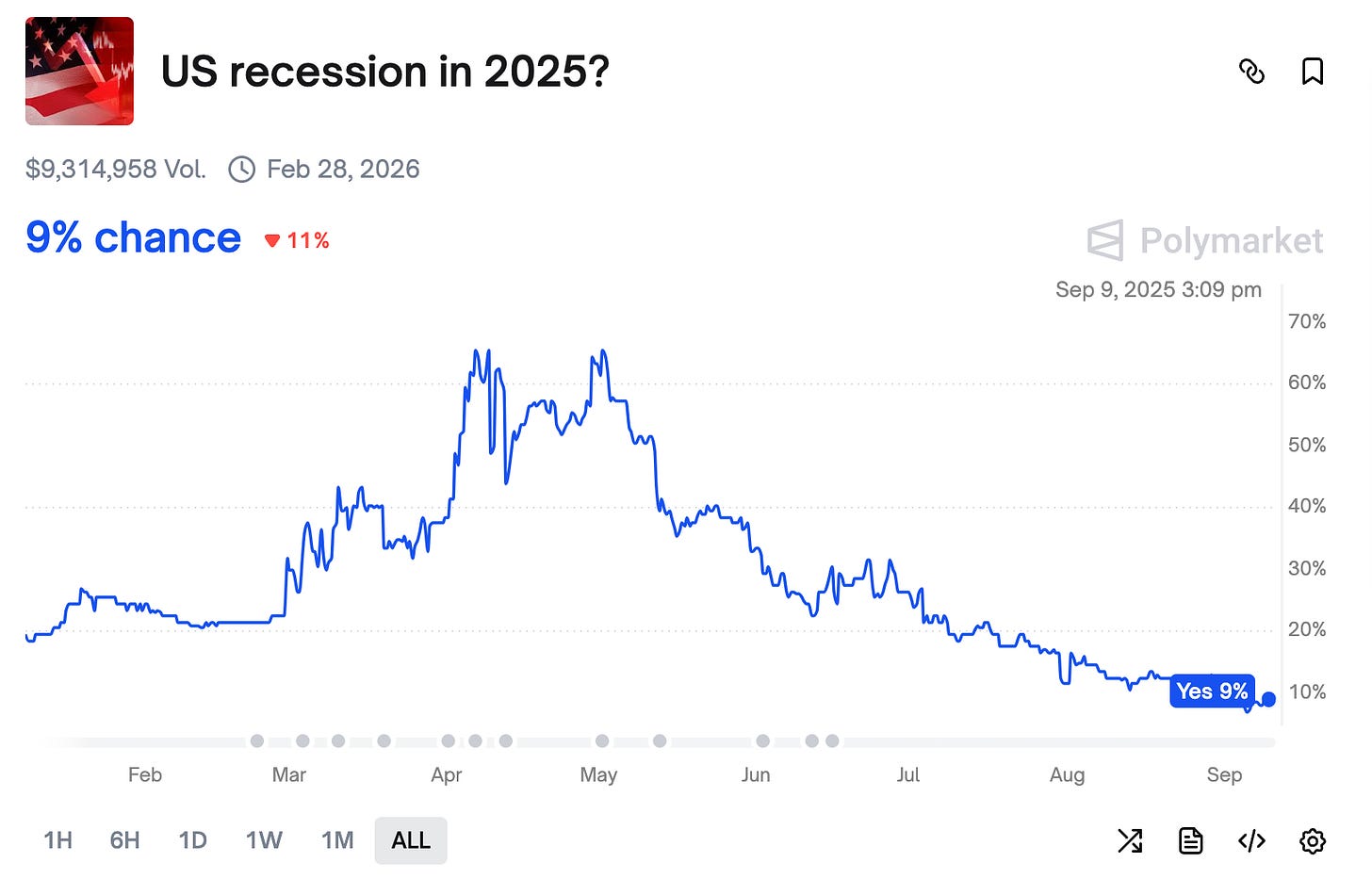

With such weak jobs data, you might be asking - does this mean we’re heading into a recession? Is downside risk also rising?

The short answer?

I don’t believe so.

Polymarket doesn’t think so either.

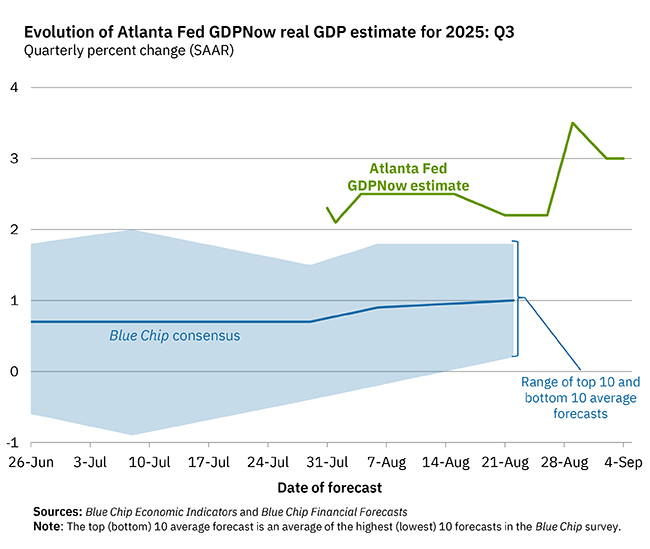

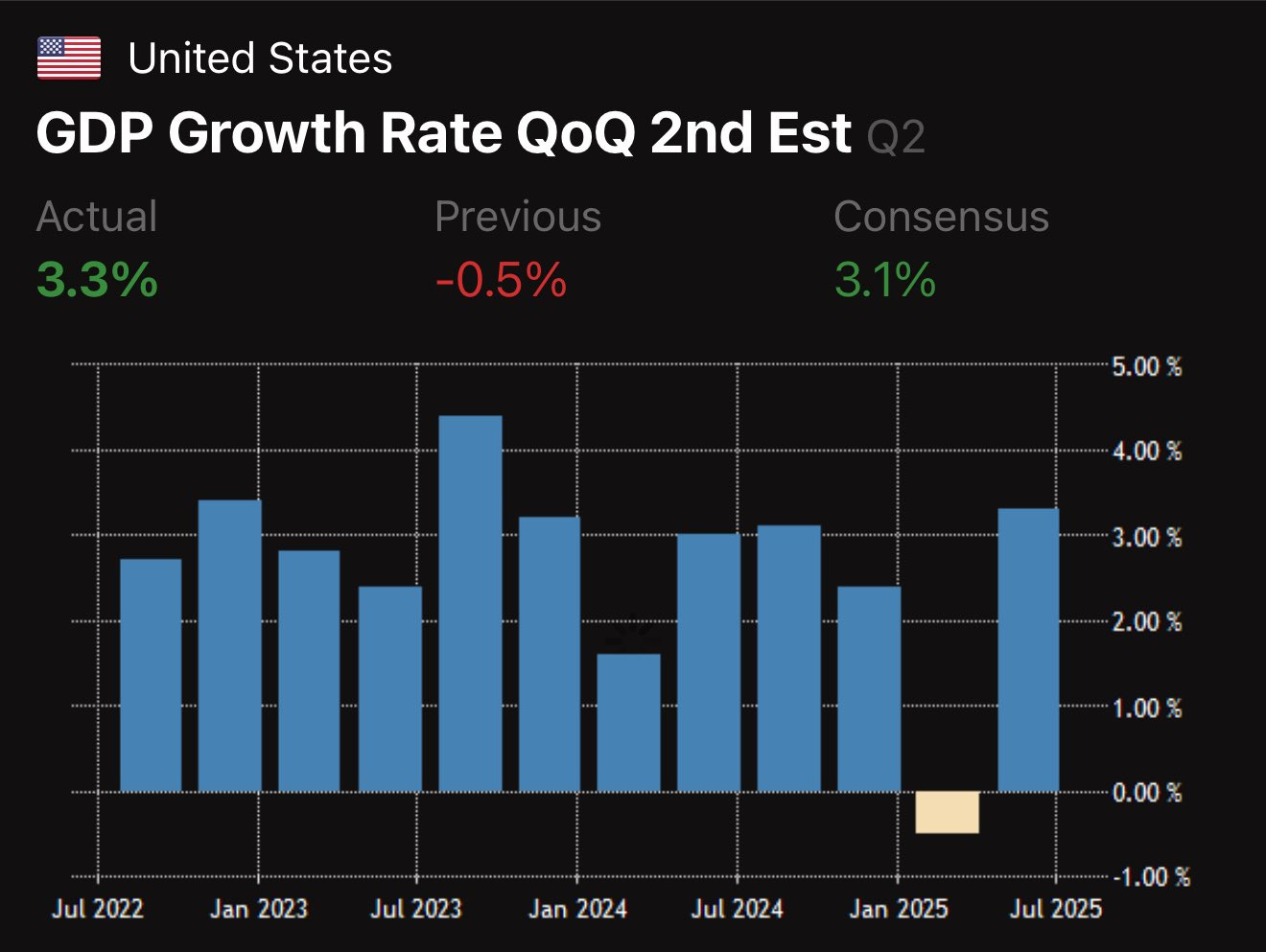

The Atlanta Fed raised stepped up their Q3 GDP forecast to 3%.

Remember, Q2 GDP came in at 3.3%, well above estimates.

Consumer spending is ramping and surprising to the upside as well.

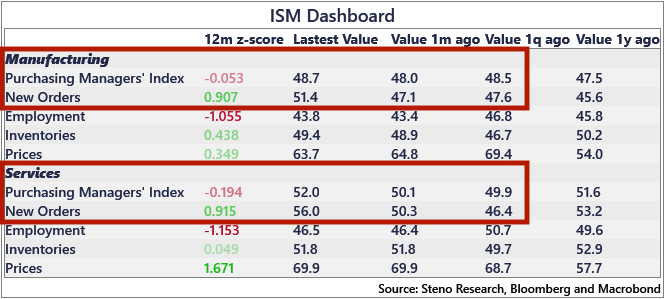

August PMIs & new orders are climbing in both the manufacturing & services sectors.

Looking ahead, things are looking good. Lower rates will support the business cycle as well.

This does not look like an economy in recession to me.

Financial conditions & liquidity

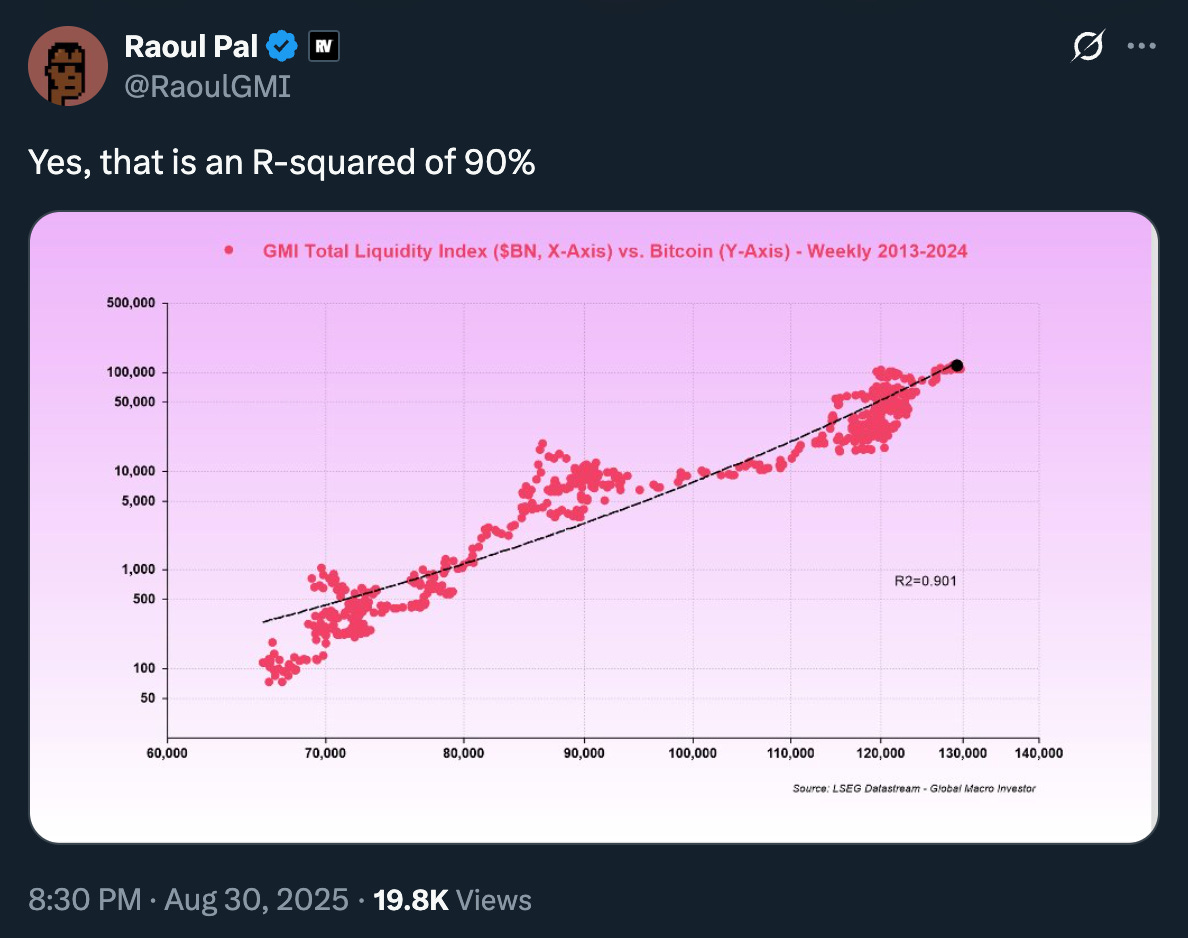

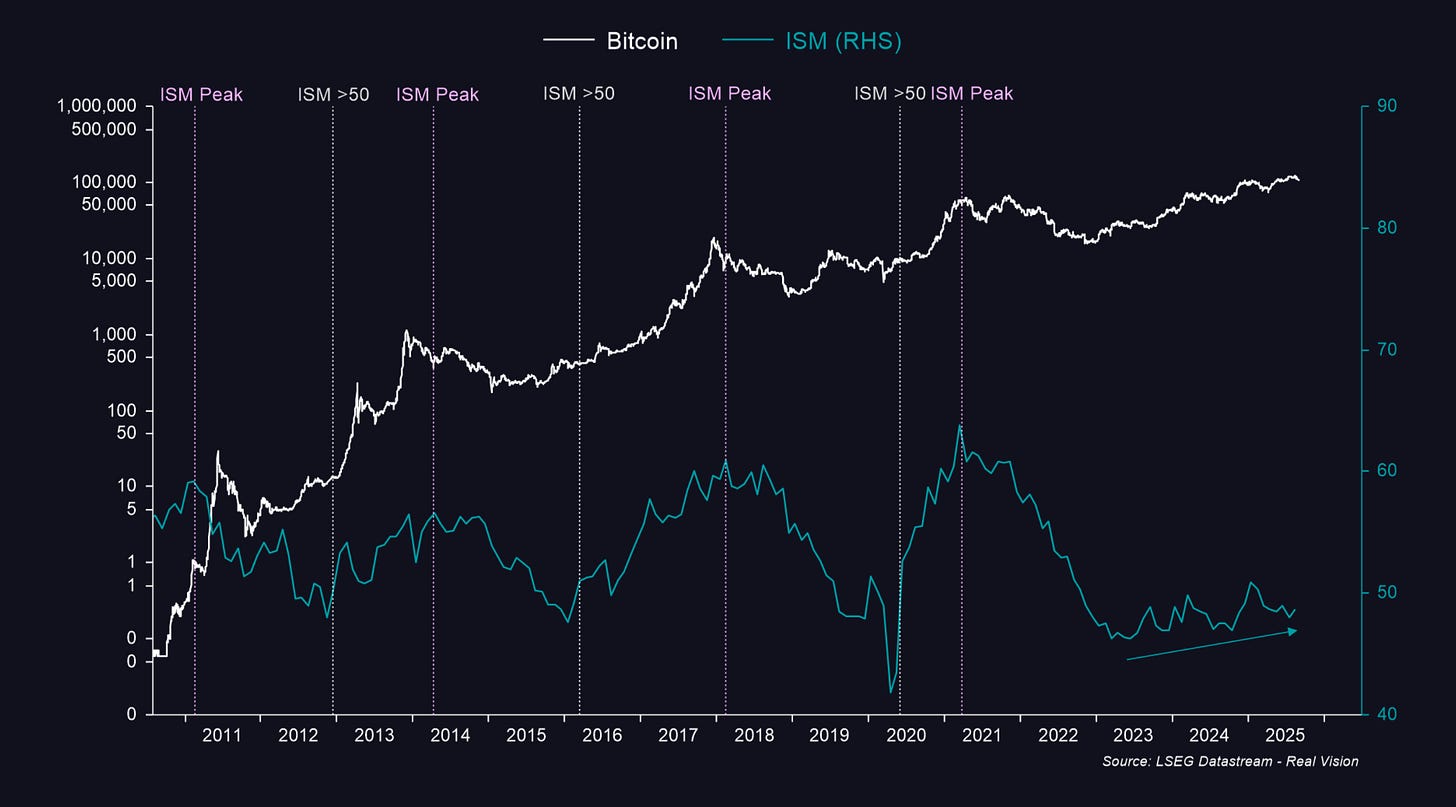

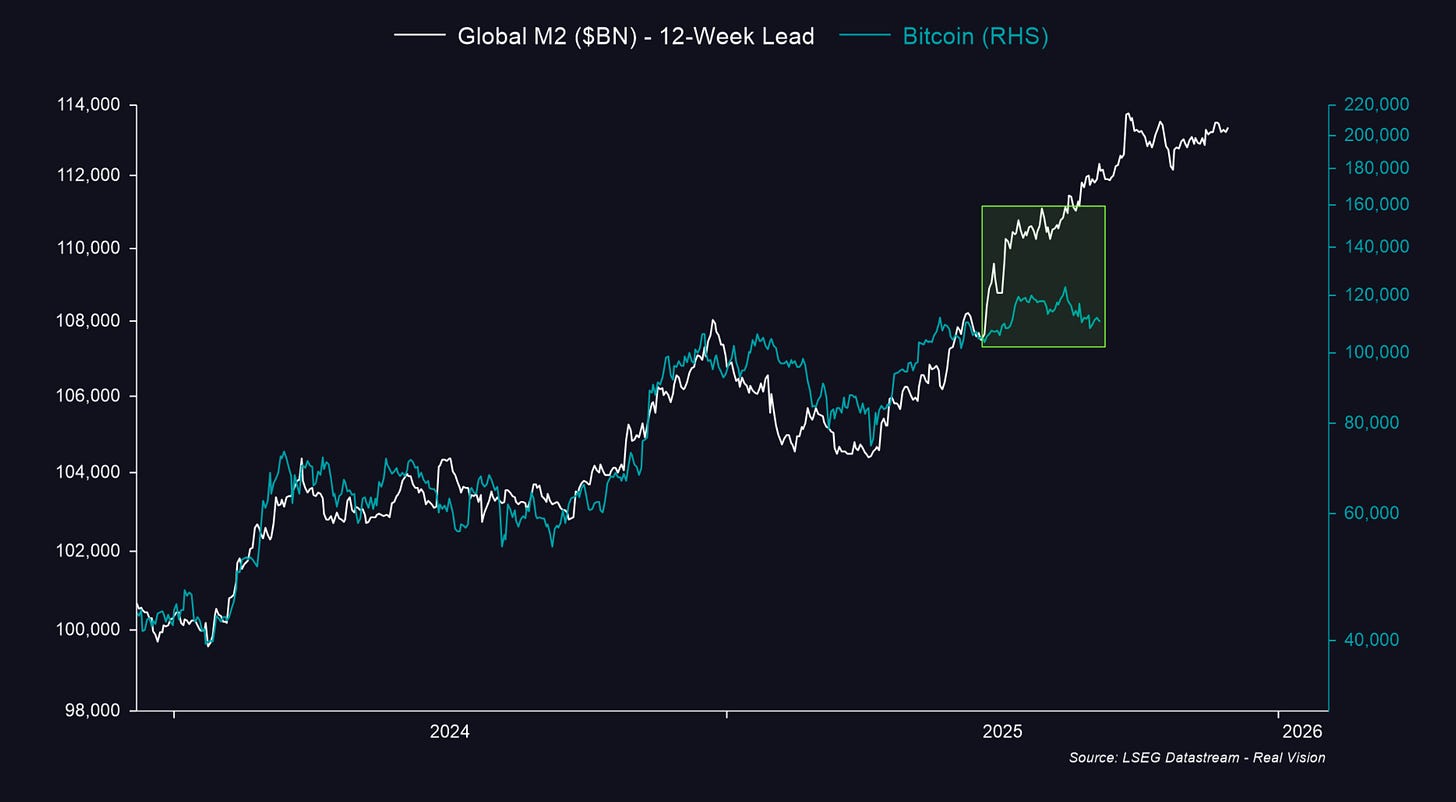

Your monthly reminder: liquidity is the most significant signal we look to for crypto performance over the medium- and long-term

And financial conditions (rates, strength of the USD, oil) are the main signal to watch for liquidity growth - easing in these factors (down, down, down respectively) frees up capital liquidity to flow to more productive, risk-seeking outlets.

The main driver of financial conditions for the first half of the year were the weakening USD and sliding oil prices. Rates stayed range-bound.

Now, we have the inverse. Rates are coming down, and the USD and oil are staying muted.

The net effect of both of these scenarios? A gigantic (even further) easing of financial conditions throughout the rest of the year, boosting liquidity, and providing a strong tailwind for liquidity-sensitive assets (like crypto).

The big move: rates

The 10-year is approaching 4% again for the first time since Liberation Day.

The 30-year is retreating from testing 5%.

Ranging lower: the USD & oil

The USD is ranging lower beneath 100, hitting lower highs.

Oil is also ranging lower.

The net effect of all this?

Easing financial conditions.

What comes next?

Liquidity

Liquidity has already shot higher throughout the year, and BTC has yet to fully price this in.

As financial conditions ease further, liquidity will continue to increase, extending the runway and fueling crypto and risk assets further.

One headwind to rising liquidity is the continued rebuild of the Treasury General Account balance at the Fed.

I’ll spare you the technical macro nerd details, but think of it like the government’s bank account cash balance. The government used it up earlier this year while they were negotiating the debt ceiling increase (they had to pay for things from actual cash instead of just taking out more debt - imagine that!), and now are rebuilding it. This is a negative impulse to liquidity because it requires taking dollars out of circulation to park them in the bank.

They’ve already taken it up from ~$300B to ~$700B, and plan to get it back to ~$850B. So, mostly done, but a bit further to go.

I’m not too concerned about this, however, given what we just talked about regarding easing financial conditions - plus, China is really starting to print.

Earlier this year, we highlighted that the whole world needed to print money to juice their economies (which were struggling even more than ours at the time), but were hesitant to do so given the strength of the USD, since printing a bunch of money would further weaken their currency against an already-strong USD.

But the weakening in the USD that we’ve seen this year unleashes more printing around the globe.

A (still) very attractive setup

If all this data proves true, here’s what we see:

An accelerating economy

Continued upside surprises

Easing financial conditions and more liquidity

Positioning is still offsides

This leads to a (still) very attractive setup in our view.

An accelerating economy

Easing financial conditions and continued upside surprises

More liquidity

Positioning is still offsides

Related things you might enjoy ⬇️

If you enjoyed this newsletter, forward it to a curious friend.

Click here to follow on Twitter.

Click here to watch and listen to spoken versions of essays, stories, and musings on YouTube.

To watch and listen on podcast apps:

If you were forwarded this email, click the button below ⬇️ and enter your email to subscribe.