🔟 Comma Partners: October 2025

A choppy month in limbo, but it's looking up

Welcome to Comma Partners

A new-paradigm crypto fund investing at the frontier of

community, technology, culture, & capital

Is it all over?

Vibes are bad. Prices haven’t looked great either. Bears are everywhere. The chop has been brutal.

Were we wrong with our call for a strong Q4? Is it all over?

[TLDR] No, it’s not over.

FUD (fear, uncertainty, & doubt) - sparked by a cocktail of the government shutdown, re-surfarcing geopolitical tensions, and October 10th’s leverage wipeout - is loud and visceral.

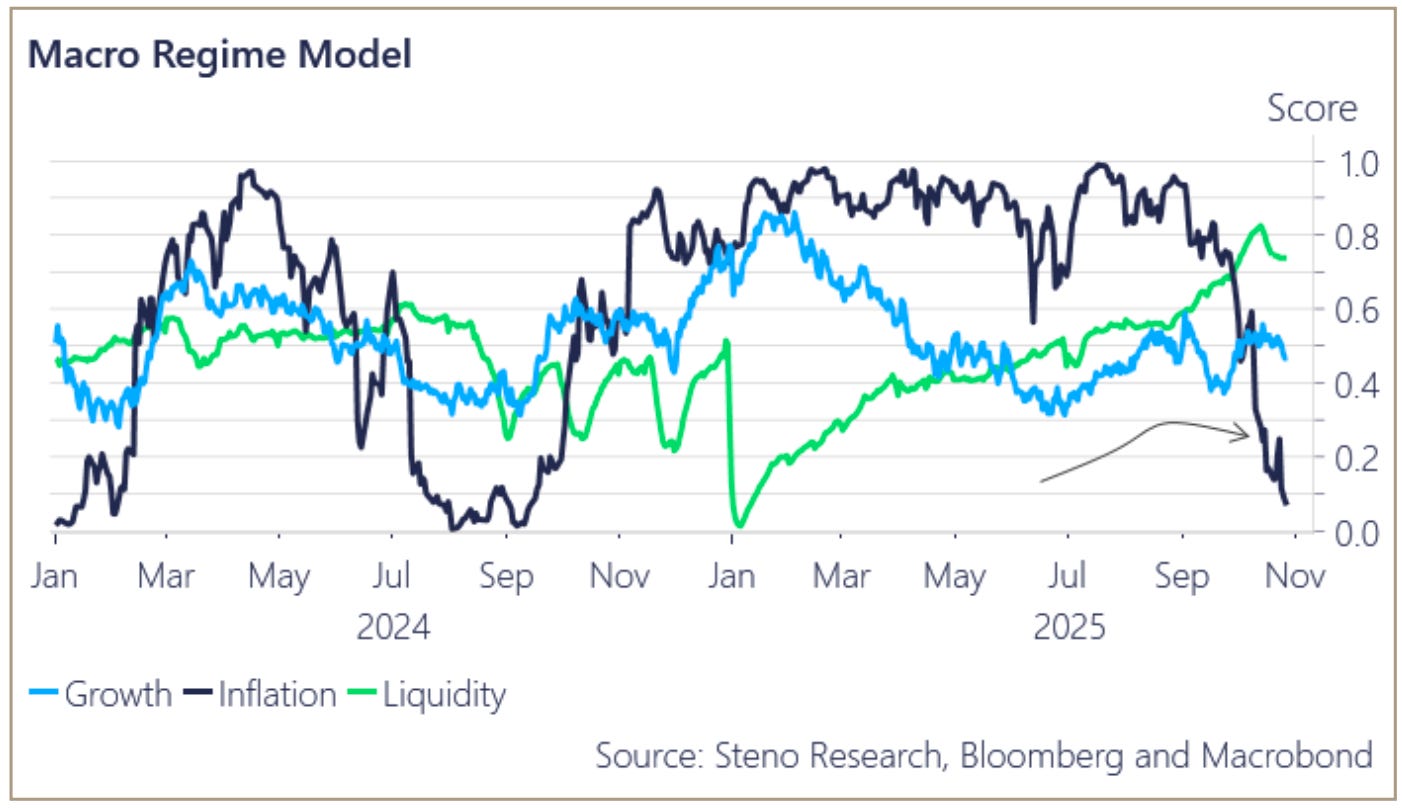

But the backdrop remains the same - signs point to easing financial conditions, rising liquidity, and a business cycle upswing to follow - all constructive to crypto.Market snapshot

Crypto:

BTC (-4%)

ETH (-7%)

SOL (-10%)

Equities:

S&P 500 +2%

NASDAQ +5%

Gold:

Gold +4%

Chop? Brutal

The chop is real: I mean, just look at the chart - the leading crypto majors experience 15%-25% swings in a matter of weeks.

Geopolitical fears once again triggered a market wipeout: China announced an expansion of their export controls on rare earth minerals, and President Trump retaliated by threatening an additional 100% tariff and export controls on China.

This sparked a flash crash on October 10th that has dramatically shaken confidence in crypto: almost $20B in leveraged positions were liquidated in 24 hours, the largest liquidation event in crypto history. Almost a month later, sentiment is still very negative.

In a one-day window:

BTC dropped as much as (-12%)

ETH & SOL dropped as much as (-22%)

Longer-tail alts fell further, with some smaller assets falling as much as (-50%) to (-70%)

Yet another trade deal between the US and China was reached.

Long-term holders are selling, in size: Since July, long-term holders have persistently sold ~300K BTC ($30B+), even as price has ranged and drifted lower, signaling fatigue even among the OGs.

[TLDR] The chop has been brutal, exacerbated by the October 10th flash crash and amplified by resurfacing geopolitical fears.

Vibes are down bad.Liquidity? Freeing up

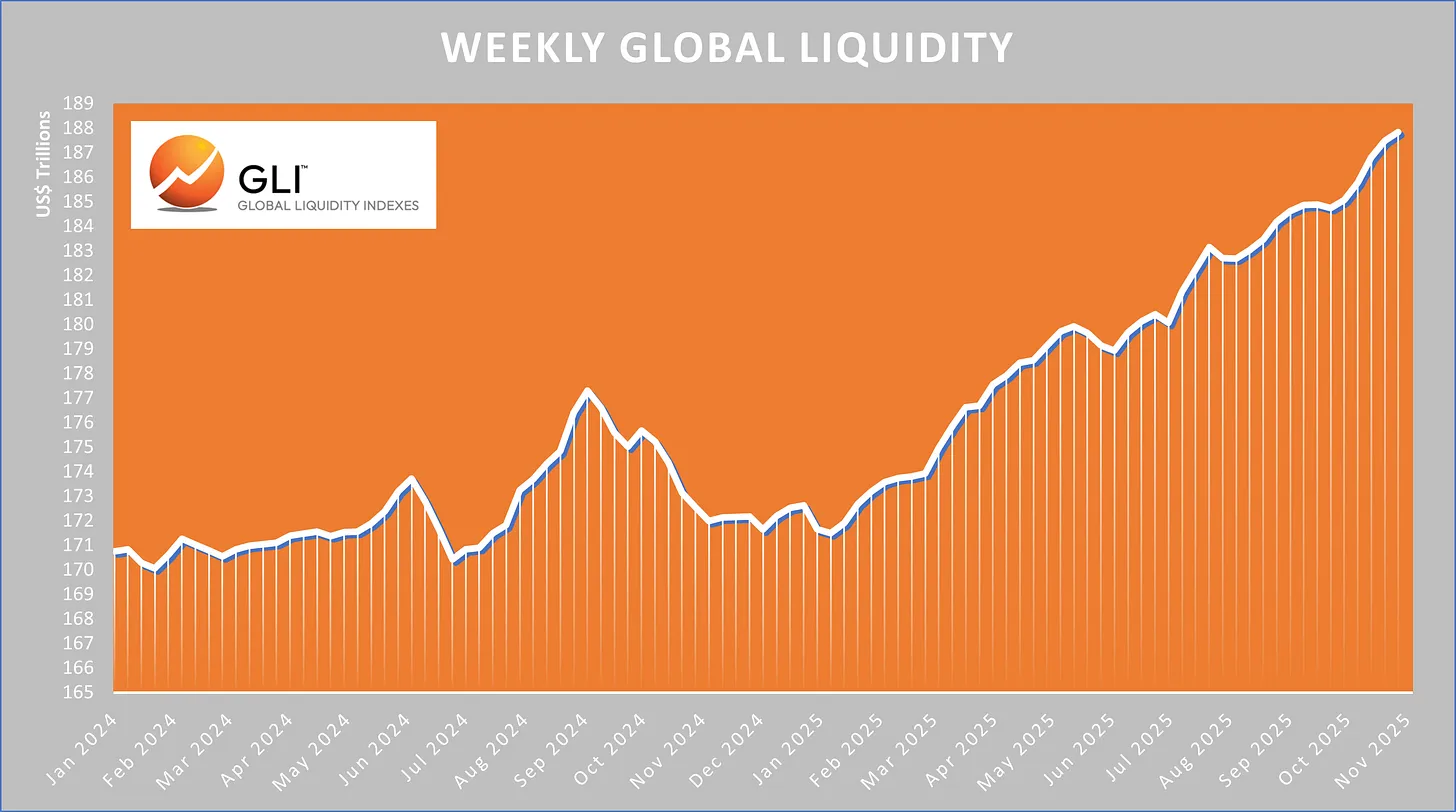

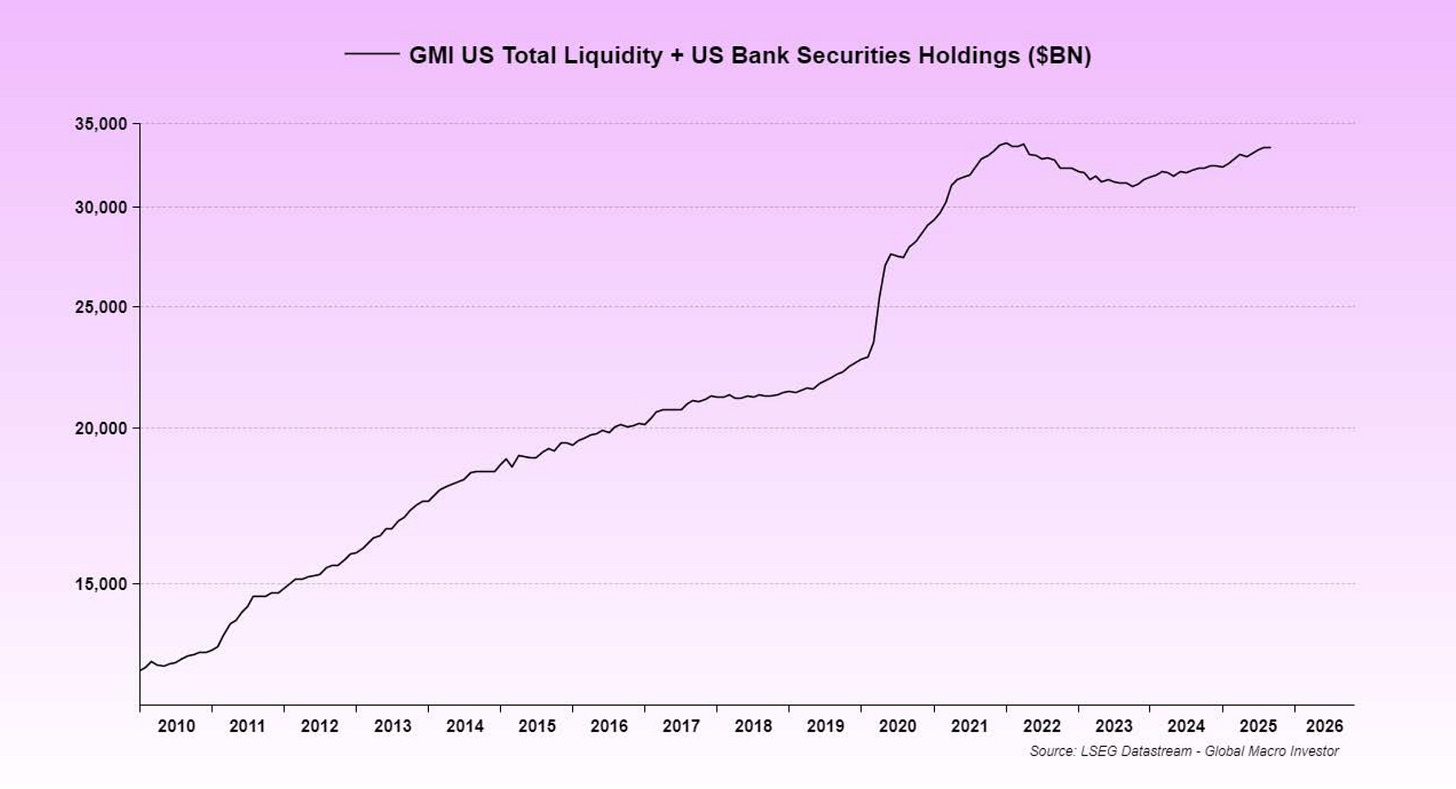

Overall, global liquidity is still slamming ATHs: Still primarily driven by China, and tempered by US liquidity slowing.

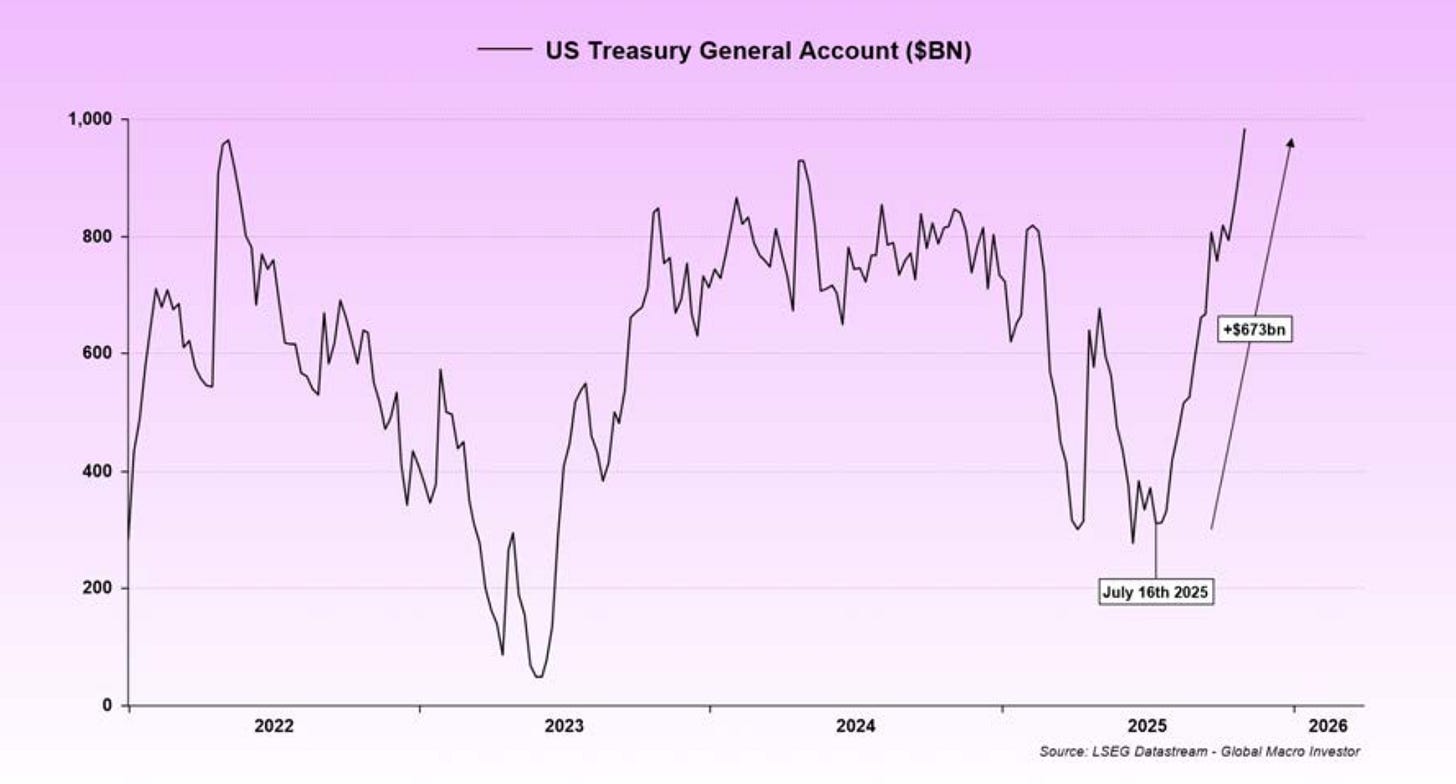

US liquidity hit a snag in October with the government shutdown: Just as the TGA refilled to the $850B target, the government shutdown. The result? An additional ~$200B in liquidity was taken out of the system, tightening US liquidity.

US funding markets started to experience some stress: This US liquidity tightening sparked some early stress in funding markets (key to the nation’s financial plumbing).

The Fed announced they will end QT: Starting in December, the Fed will end QT, a tailwind for liquidity on the margin.

Catalysts are on the horizon for US liquidity to start expanding again: The government shutdown ending, QT ending in December, and funding market stress all pressure the Fed to respond in support of liquidity.

[TLDR] US liquidity has been stagnant. That said, the US is approaching a pivot point that will bring increasing liquidity. This is on top of global liquidity still slamming ATHs.Macro? Still solid

The Fed cut rates again: We got another 0.25% rate cut in October.

Inflation remains a non-issue: Inflation data is lagging as a result of the shutdown, but September’s data showed inflation coming in below expectations.

Growth surprises will matter more on the margin: Counter to much of the public narrative, inflation signals are still collapsing, while growth remains strong.

The Fed highlighted uncertainty to a December rate cut decision due to missing data from the government shutdown: The market interpreted this uncertainty hawkishly. We fade the fear.

[TLDR] Despite government shutdown-related uncertainty, macro data still supports a December rate cut in our view, and we think fear is overblown.

At this point, the Fed is more constrained by liquidity strain on funding markets than by inflation. We see more cuts on the way.So, is it all over?

We’ve been in limbo, with the government shutdown putting a halt to much of the normal course of macro data and Fed decision-making. The market hates uncertainty.

The October 10th flash crash has crypto sentiment shaken to its core. We need a new catalyst to move up again. We think we get it.

[TLDR] No, it’s not over.

Our macro and liquidity frameworks still look constructive 6-12 months out. Uncertainty is inevitable, and we got some this month.

FUD can sound compelling, but it doesn’t mean it’s right.

Our view is that the plan remains the same, just delayed a bit. We remain invested.Until next month,

Devin

Related things you might enjoy ⬇️

If you enjoyed this newsletter, forward it to a curious friend.

Click here to follow on Twitter.

Click here to watch and listen to spoken versions of essays, stories, and musings on YouTube.

To watch and listen on podcast apps:

If you were forwarded this email, click the button below ⬇️ and enter your email to subscribe.