9️⃣ Comma Partners: September 2025

Goldilocks, with liquidity pouring fuel on the fire

Welcome to Comma Partners

A new-paradigm crypto fund investing at the frontier of

community, technology, culture, & capital

Goldilocks?

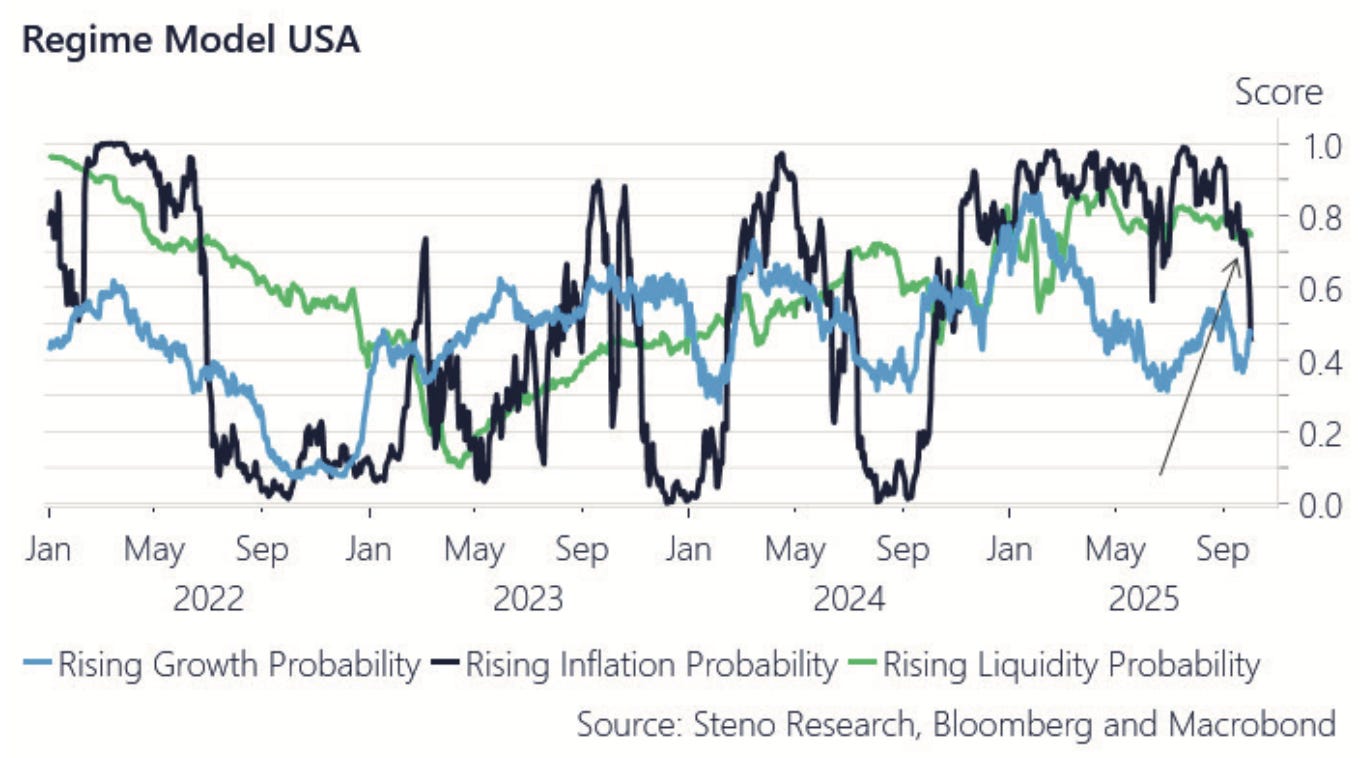

In our view, the story is very similar to last month. Business cycle fundamentals signal strength. Rates are being cut into a resilient economy. Market positioning is still offsides

The only thing that’s different? There’s more fear. Everyone’s concerned about either a frothy bubble bursting or a recession crashing.

[TLDR] We think we’re entering a goldilocks period. Strong growth, stable inflation, increasing liquidity.Market snapshot

Crypto:

BTC +6%

ETH (-6%)

SOL +4%

Equities:

S&P 500 +5%

NASDAQ +5%

Gold:

Gold +12%

Macro? Strong enough, despite recession fears

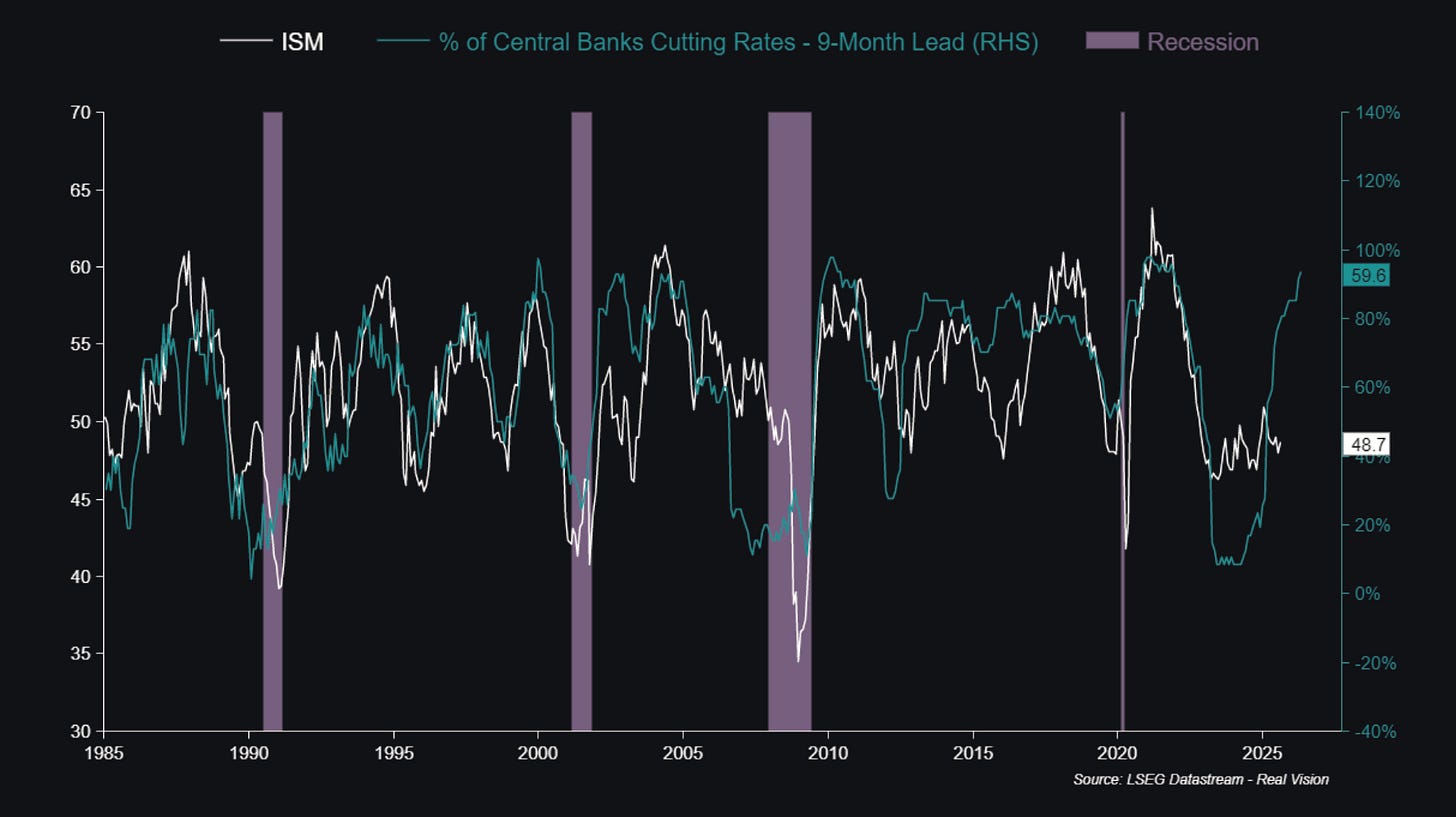

The Fed cut rates: 0.25% rate cut in September, the first cut in 2025. This is a tailwind for the business cycle more broadly, as cheaper capital = more growth.

Jobs figures stay weak: BLS data delayed due to the government shutdown, but ADP data reflected a loss of 32K private sector jobs in September.

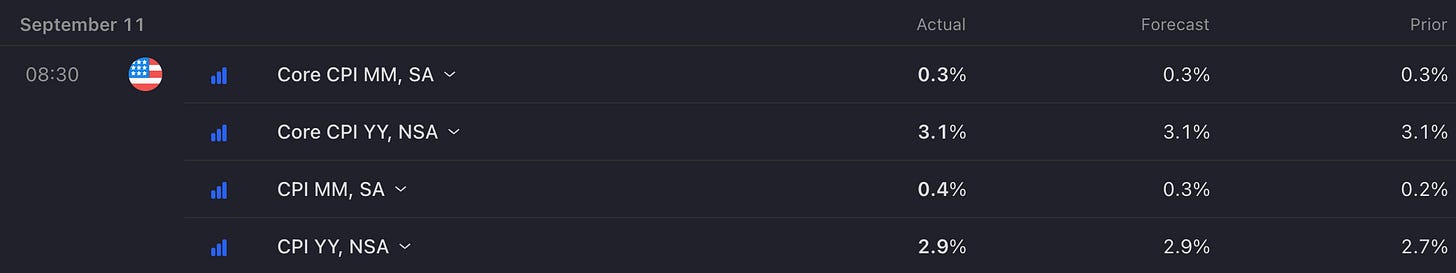

Inflation stays stable: Still above the Fed’s 2% target, but not reaccelerating as many fear. We’re in an AI investment supercycle, with capex going into productive infrastructure projects (pro-growth), not people’s pockets (inflationary).

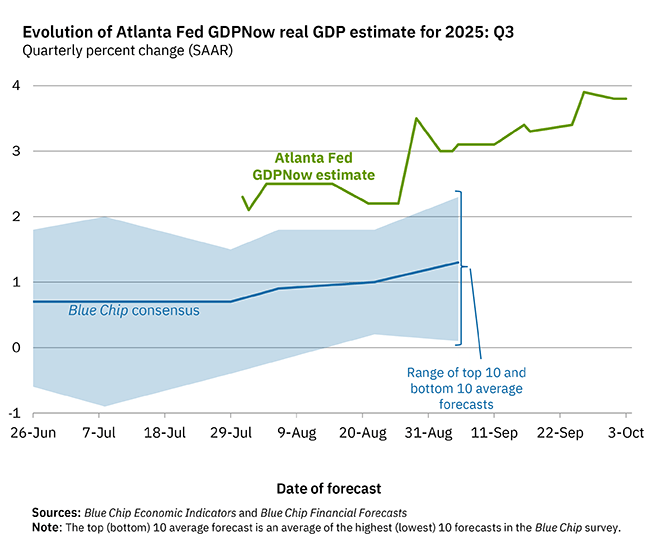

Growth is strong: Q2 GDP revised up to 3.8% (vs. 3.3% forecast). Though distorted as a result of mechanical trade calculations impacted by tariff front-running in Q1, growth still stronger than expected. Q3 forecasts also rising, now at 3.8%.

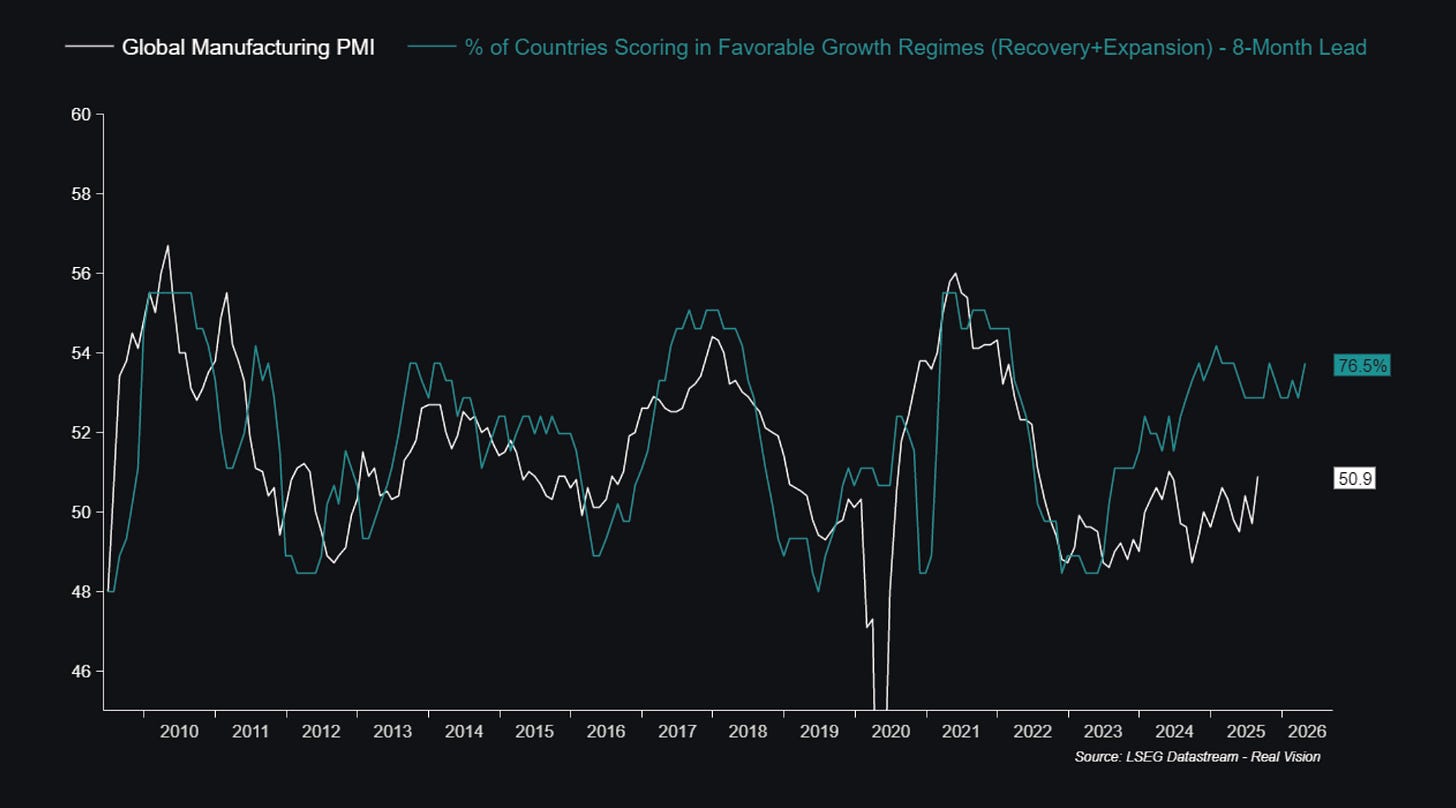

Leading indicators show strength: Global growth is trending up, financial conditions are still easing, and all is further fueled by nearly 100% of global central banks cutting rates.

[TLDR] Softness in the labor market is driving the Fed to cut, which will continue to pour fuel on the fire. Recession fears are overblown.

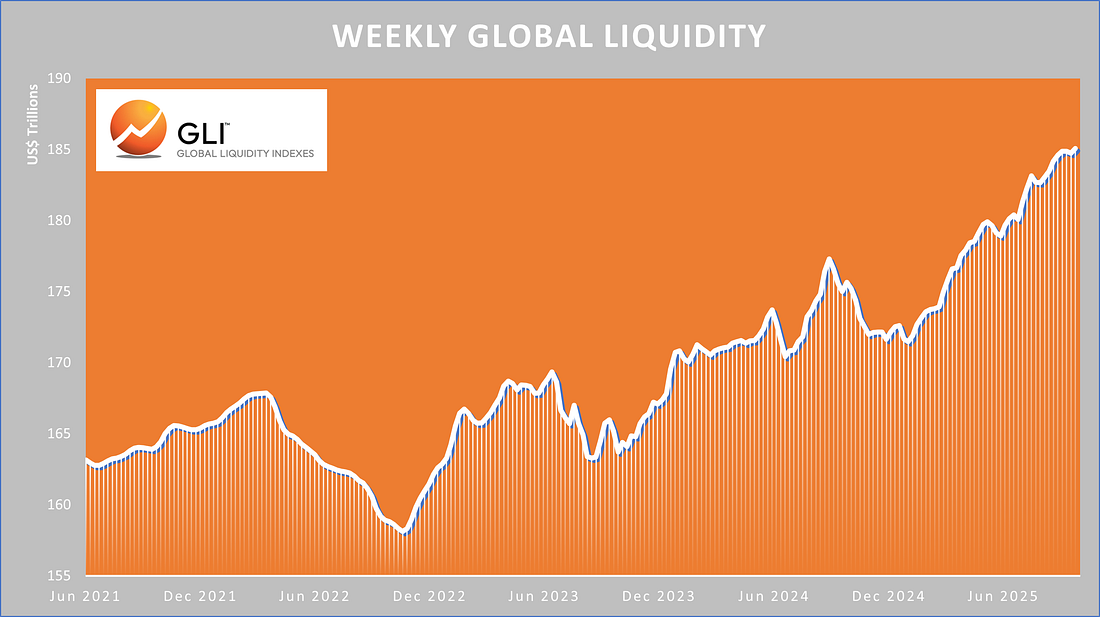

Goldilocks.Liquidity? Still slamming ATHs

Global liquidity slamming ATHs: Driven primarily by China and a weakening USD, upward momentum continues.

Gold is leading the way for BTC: Gold is relentlessly punching new ATHs, reaching past $4,000. Gold usually leads BTC price movements by ~6 months.

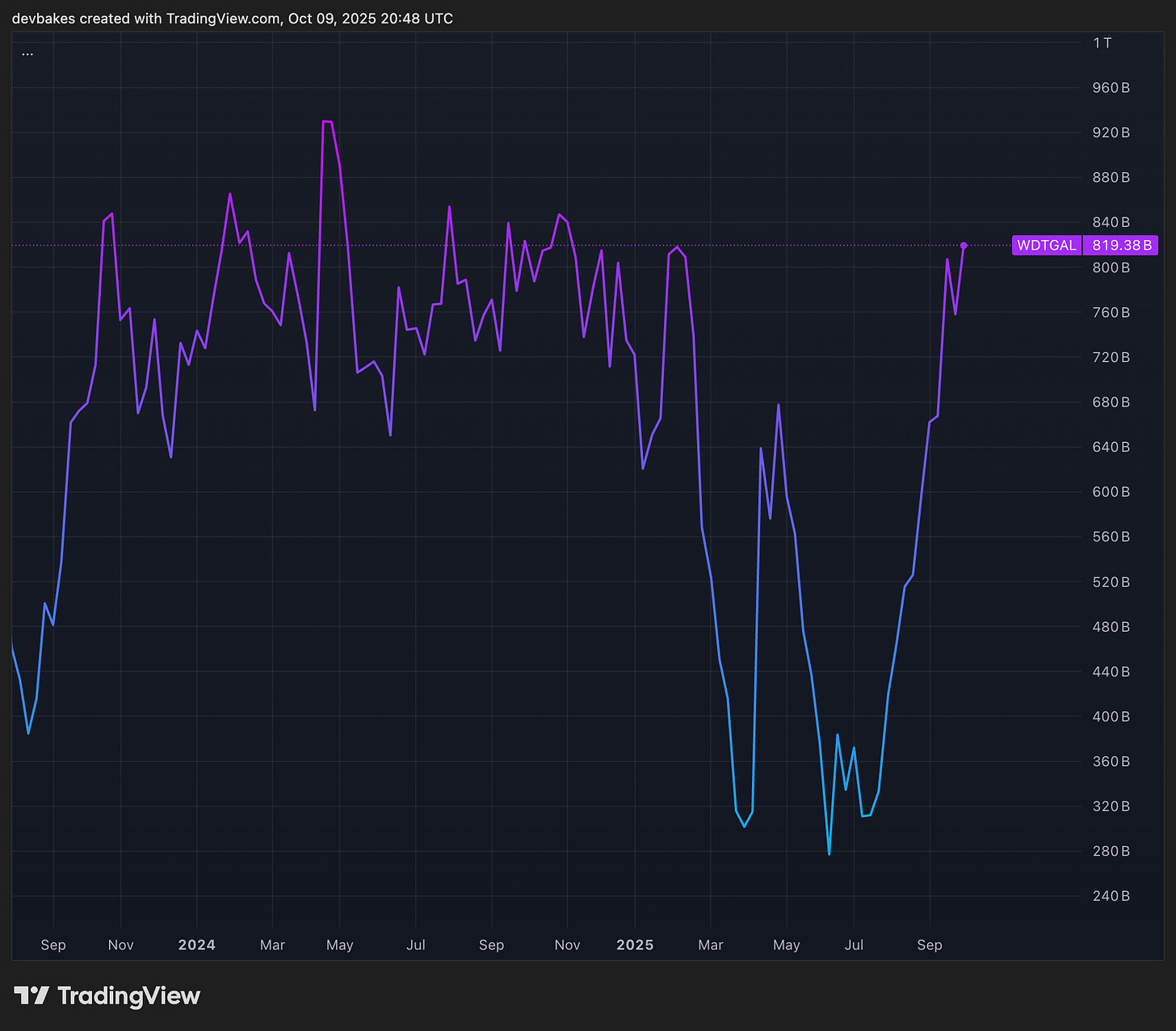

TGA fully refilled

The Treasury sucked ~$500B of liquidity out of the system since late July as they refilled their bank balance (which they use to pay for government operations) back to their $850B target.

Despite this headwind, liquidity nonetheless has continued to climb past ATHs. This headwind is now gone. Bullish liquidity.

Lowering rates fuels liquidity via credit creation:

Lending becomes more attractive for banks as the spread they can earn between what they earn when they lend (longer-term rates) and what they owe on their bank deposits (shorter-term rates) increases.

With the Fed lowering short-term rates, it will:

Fuel traditional business cycle acceleration, as businesses can borrow to fund growth more cheaply.

Unleash liquidity via private credit creation as the yield curve steepens, and banks lend more.

[TLDR] On top of business cycle and growth tailwinds, liquidity keeps climbing, and is now free of headwinds from the TGA refill.Headlines? Every week

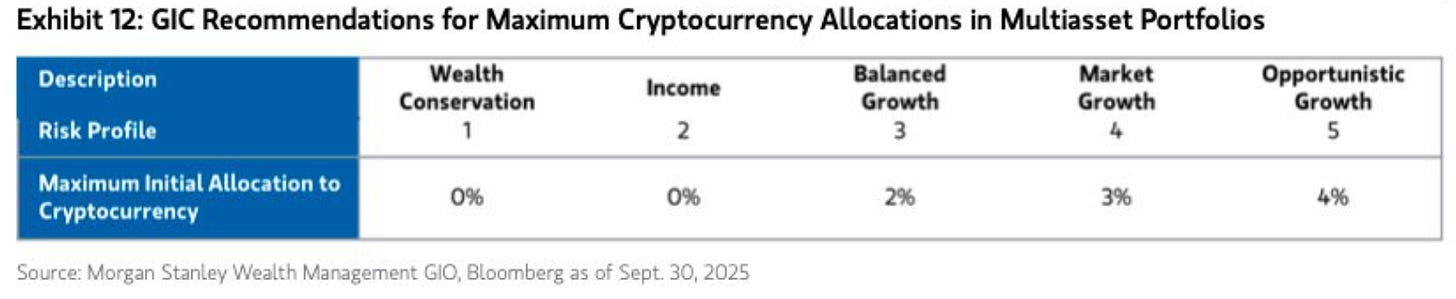

Morgan Stanley recommends crypto: MS’s Global Investment Committee issued a special memo recommending crypto allocations. MS advises ~16K advisors who manage ~$2T.

Vanguard (finally) exploring crypto: Under a new CEO, one of the most stalwart crypto holdouts is finally exploring allowing crypto access to clients. Vanguard manages ~$11T of AUM.

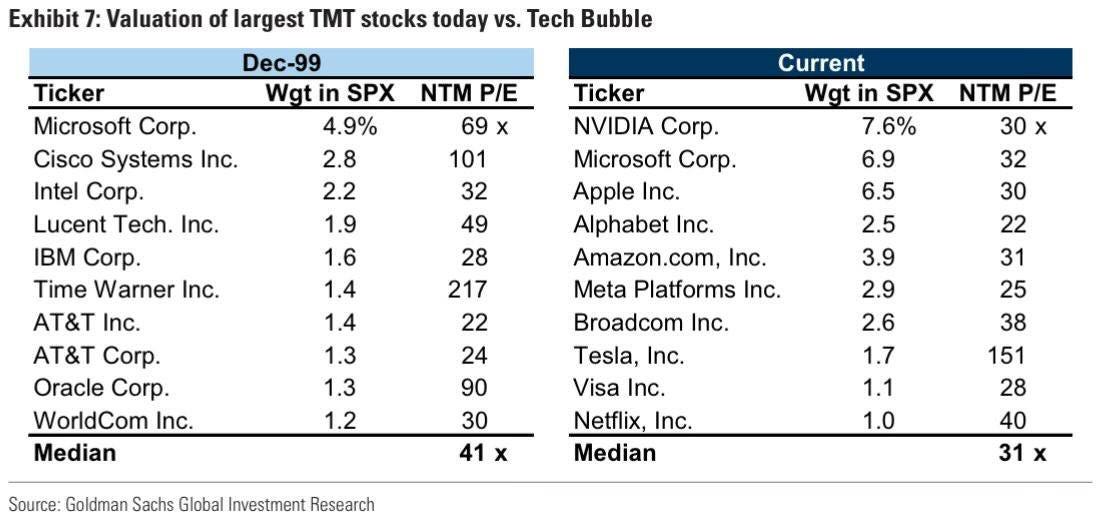

The risks? Bubble or recession

Fear is everywhere, but there’s no consensus.

There are fears that we’re in a booming bubble that’s about to burst. There are fears that we’re in a recessionary economy that’s about to crash.

Bubbles rarely burst and recessions rarely crash when everyone is afraid of them.

We think neither are true.

[TLDR] We see business cycle fundamentals signaling strength. Rate cuts into an accelerating economy. Market positioning still offsides.

We think we’re entering a goldilocks period. Strong growth, stable inflation, increasing liquidity.Until next month,

Devin

Related things you might enjoy ⬇️

If you enjoyed this newsletter, forward it to a curious friend.

Click here to follow on Twitter.

Click here to watch and listen to spoken versions of essays, stories, and musings on YouTube.

To watch and listen on podcast apps:

If you were forwarded this email, click the button below ⬇️ and enter your email to subscribe.